We all feel the rush of time around now, the holidays racing towards us followed by the ringing in of another new year. Before you know it, you’re wondering where the time went… for most 501(c)(3) organizations, November is the deadline month to exercise their state unemployment tax exemption for 2018. That means you need to act now.

Unlike for-profit organizations, 501(c)(3) nonprofits have the unique opportunity – as allowed by Federal law – to opt-out of the state unemployment tax system and instead only reimburse the state, dollar-for-dollar, if and when they have an actual unemployment claim. It can be a savings opportunity for many nonprofits who have lower claims than what they pay in state unemployment taxes—which are often driven up by for-profit organizations and other companies that go out of business, as well as state fund deficits and improper payments made in error.

The Unemployment Services Trust helps nonprofits to better manage their cash flow through proper claims administration and safety reserve building. With access to e-Filing capabilities, state-specific claims advice and a plethora of on-demand HR services, UST participants are able to streamline operations and reduce back-office paperwork burdens.

Last year alone, UST helped program participants save $27.8 million in unemployment claims costs. That’s millions of dollars more for the nonprofit sector and the communities they serve.

More than 2,200 of your nonprofit peers are already exercising their unique tax alternative with UST. Rather than overpay into the State unemployment fund – effectively subsidizing for-profit companies – wouldn’t it be more true to your mission to allocate that wasted overhead to your programs and services?

Submit your FREE Cost Analysis Formno later than November 15th in order to meet the state deadline for 2018 enrollment – which for most states is December 1st. Unfortunately, if a nonprofit misses the state deadline, they have to wait until the following year to exercise their tax exemption and join the UST program.

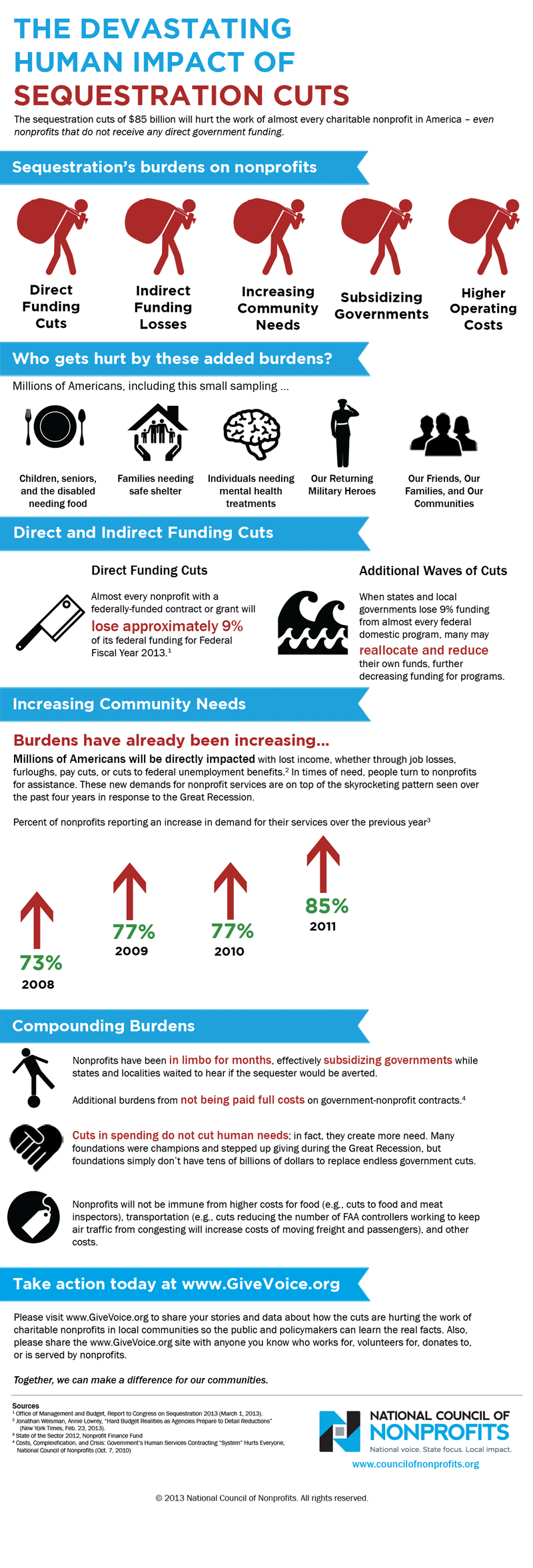

Nonprofits who rely on state and other government funding should prepare for a bumpy road ahead in the next couple years says a new report produced by independent philanthropy consulting firm “Changing Our World, Inc.” Although the economy is seeing a shift toward the positive, state tax revenue – and therefore funding for many nonprofits – is nowhere near stable. And while the number of nonprofits has been steadily rising over the past 15 years, charitable giving has dipped significantly and would need an unprecedented rally to make up for the government funding shortfall.

Since World War II, the average recession in America had lasted 10 months. Until Now.”

Unemployment alone has created a crisis in many states. In fact, 44 “crisis states” have significantly reduced spending and are expected to cut spending even more (by $38.5 million) in social services, education and Medicaid says the report. Despite $1.5 trillion of American household wealth lost in just the first three months of the recession, philanthropy on the other hand, has been making modest gains and is expected to slowly trend upward. But the dollars are spread thinner as the number of nonprofits increases and the demand for services explodes. As the Chronicle of Philanthropy put it: “To help nonprofits cover cuts in those services, households in the hardest-hit states would have to step up their giving by 30 percent in 2011 and 60 percent in 2012—an increase the report says would be ‘historically unprecedented.’”

So what’s a nonprofit to do?

The report concludes that a multi-faceted strategy is needed for every nonprofit. Waiting on philanthropy or government funding to recover won’t work. “Philanthropy will be an important, indeed critical piece of that strategy, in part because philanthropy is often flexible and can fill in gaps not financeable through other means. However, the sheer weight of the burden will require that multiple revenue pathways be opened as well as that every managerial option for efficiency be considered.”

For nonprofits looking for a guide to this multi-pronged approach, we gleaned these tips from the report:

• Efficiency – Reach out to unemployed workers to become volunteers, possibly with a stipend. You’ll not only give them a step in the right direction but you’ll receive valuable man-hours.

• Collaboration – Reducing overhead costs is possible through a number of collaborative efforts like merging of back offices, joint purchase of property, combination of nonprofits with similar programs into a single service network, etc.

• Messaging – When asking for donations, emphasize progress instead of crisis. Talk about all the good the organization is doing in the face of the economic crisis, not how it’s struggling.

• Financial Expertise – Learn more about managing cash flow and accounts receivable so you can weather late payments and financial dips. Become your own expert on economic trends. Also think about adding people to the board with financial expertise or government experience.

• Don’t Rely on One Source – No more than 60% of any program’s budget should come from government money.

• Maintain a Reserve – This fund should be triggered only by the Board or the Finance Committee, and saved for lean times.

Robin- UST AP Specialist/Claims Analyst

In 1976, Robin’s parents did the unthinkable. They drove across the U.S.—from Southern California to Montreal, Canada—with 3 small children in tow.

For days they stopped at historic landmarks across the East Coast letting their children experience the excitement and historic fervor of some of the most famous historic landmarks in the U.S., including the Liberty Bell, the Statue of Liberty and many others in Washington D.C., before attending the Summer Olympics in Montreal.

Still her favorite childhood memory, it’s possible that this early exposure to the many different cultures of the U.S. helped ground her in her hometown of Carpinteria—where the UST administrative office is located—and led her to UST where she enjoys working with state agencies on behalf of our members.

“I knew UST would be a perfect fit for me,” Robin says, “the challenges of working with state agencies on behalf of nonprofits and providing the best customer service that I can is something that I love doing every day.” And, she sheepishly admits, “I loved the idea of working in my own community. I’ve lived here all of my life, but I’ve never actually worked in town.”

But with only 3 stoplights, and a downtown area that is only about four blocks square, it’s not surprising that Robin had never before worked in town—even if her Grandmother’s portrait does hang in the town’s historic museum.

Have questions for Robin? Want to swap Olympic memories with her? Tweet us @USTTrust!

When looking to apply for future grants, GrantAdvisor can serve as a beneficial nonprofit resource for your organization. GrantAdvisor is an online service that allows for open communication between nonprofits and grantmakers by collecting authentic, real-time reviews and comments on the experiences grantseekers’ have when working with funders. Created to encourage a more productive philanthropy amongst grantseekers and foundations.

This service is designed to grant applicants, grantees, and others to share their first-hand experiences working with funders and for funders to respond on the record. With all feedback collected and shared anonymously, GrandAdvisor hopes this will encourage grantees to be transparent. Once 5 reviews have been collected for a particular funder, the data will be shared publicly. This provides an opportunity for the foundation to respond to comments and to see how they are perceived in their field—not only as grantmakers but also as leaders and influencers. With this service, GrandAdvisor hopes to improve the relationships between grantmakers and grantees while strengthening the fields the funders work in.

GrantAdvisor is an initiative brought together by its’ project partners, Jan Masaoka, CEO of California Association of Nonprofits, Perla Ni, CEO of GreatNonprofits and John Pratt, Executive Director of Minnesota Council of Nonprofits. “One of the most important differences between nonprofit organizations, businesses and governments is the way they receive their funds,” said John Pratt. “The goal of GrantAdvisor.org is to elevate the reliability and depth of this external grant information through crowd sourcing, pattern recognition and public peer exchange to make the whole process clearer and more transparent.”

With their launch in June 2017, GrantAdvisor is currently available in California and Minnesota—new locations and partnerships are scheduled to be announced this year. We look forward to seeing wonderful things happen for this up and coming organization! To learn more about GrantAdvisor visit https://grantadvisor.org/

The end of our mnemonic prioritizing what you want most in your benefits and salary package at a new nonprofit is often the hardest. It requires that you legitimately sit down and determine which benefits are the most important to you and where you have the most wiggle room.

For instance, the title of your position more important than the amount of money you make a year? Is an extra $3,000 or $5,000 of salary a make or break issue for a position that you would love to have?

Prioritize

If you get too hung up on a single point in the negotiation process, it can slow everything down and create issues that may haunt you later down the line.

And remember, if you do anything out of line in the negotiation, or if anything in your package is seen as excessive, controversial, or deemed “special interest” there may be problems down the line when it comes to managing your team and working with other stakeholders throughout the organization. So, if you don’t think something in your package is worth fighting for long after negotiations are over, consider leaving it out.

What other tips do you have for negotiating a nonprofit compensation package? Are there things that you can’t live without? Tell us about them on Facebook, Twitter, or LinkedIn!

Because, as you know sometimes jobs come along that are simply too good to turn down, so in these cases it’s even more important that you recognize the difference between what you need, what you want and where the difference is.

Focus on the future in your negotiations to make sure you don’t get stuck in your financial past.

Focus on the Future

If you can, evaluate the non-monetary points of the compensation package to determine if they help fill the gap. Maybe you are able to take a leave of absence every year, or you can create flexible working hours that allow you to work during the times that make the most sense for your life. Since the monetary portions of any compensation package are often the most stringently reviewed—and the least likely to pass muster—look at the amount of value that is gained from other components of the proposed compensation package.

If even this doesn’t pass your compensation test, consider whether you (and the organization) would be interested in revisiting the package a few months down the line when you have shown your worth. It’s possible that the decision makers may be more inclined to offer you better perks if you have proven yourself a valuable member of their organizational team.

What other tips do you have for negotiating a nonprofit compensation package? Are there special things that you don’t think you’d be able live without in the future? Tell us about them on Facebook, Twitter, or LinkedIn!

A sunset Megan captured outside her house last week! How gorgeous is that?!

After starting out with UST’s Accounts Payable department, Megan C. was excited to be offered a position as a Customer Service Representative in February. “I was excited about helping nonprofits potentially save money on their operating costs after having volunteered with nonprofits in the past,” she explains.

“I worked with MDA and helped with their Fill the Boot and Winter Wine Down campaigns. And although I still haven’t had the chance, I’ve wanted to work with the Make-A-Wish foundation since they helped my cousin, who was battling an unknown cancer, ”* she says.

“My cousin was 19 when he passed away and really into gaming, so the Make-A-Wish foundation redid his room and decked it out with all sorts of entertainment and gaming systems that he was then able to play. It made a big difference to him.”

Growing up with a large family, Megan treasures her memories of summers on Cape Cod and at the beach, Thanksgiving with her whole family present, and her grandparents’ stories of growing up in Greece. “Being half Greek, and hearing their stories throughout my own childhood, my grandparents have easily convinced me that I want to visit and experience the culture first hand.”

Have questions for Megan? Tweet her @USTTrust with the hashtag #MeetUSTMondays!

*About 5 percent of those diagnosed with cancer have a previously unrecognized form.

With a possible government shutdown still looming on the horizon, many organizations who receive government funding are probably reviewing their plans for staffing during this period. And as uncertainty continues, it’s important to ensure you are fully aware of the legal implications of any actions you take.

Organizations have a number of options depending on their situation though. Affected organizations may determine that they cannot afford to pay their employees during the shutdown so they may chose to furlough staff, reduce pay, or require employees to take leave (using accrued, advanced or unpaid leave). They may also send their employees to mandatory training. But what if too many employees of a protected class are effected by decisions? Or if employee’s exempt status is violated when requiring time off?

The experts at Nonprofit HR have put together an information packed white paper that can help make your decision making easier. Download the full white paper here.

In an Effort to Help More Nonprofits Reduce Overhead Costs and Lower Their Unemployment Tax Rate, UST Support Now Provides Workforce Solutions Specifically Tailored for Nonprofits in the State Unempl oyment Tax System.

Santa Barbara, CA (November 7, 2017) – The Unemployment Services Trust (UST), a program dedicated to helping nonprofits ensure compliance and protect assets, today announces the revision of a standing program, UST Support, which will now cater to both tax-rated and direct reimbursing nonprofits. UST Support provides cost-savings tools to nonprofits that are looking to offload burdensome unemployment claims management processing in order to allocate more time and money to their core missions.

Since 1983, UST has served direct reimbursing nonprofits with the HR resources and unemployment claims management tools they need to keep more money within the nonprofit community. Now, UST Support offers a solution specifically designed to provide tax-rated organizations with valuable benefits to operate efficiently while saving money.

The UST Support program offers exclusive access to the following services:

– Professional Claim Administration

– Professional Representation at Appeal Hearings

– CaseBuilder Online Claims Management

– Live HR Hotline, Online Compliance Library and Training

– Outplacement & Career Transition Services

– Budget Guidance from Certified Actuaries

In addition to these robust resources, UST Support now provides several features designed to help tax-rated employers better manage their unemployment costs. One of these tools includes rate forecasting—an aid used to help with budgeting and cash flow management. Plus, our claims administrator’s annual analysis can help you decide whether a voluntary contribution can be used to lower your unemployment tax rate—providing long-term savings for your organization.

“Nothing is more rewarding than hearing how our support has helped nonprofits to better serve their communities and support their missions,” said Donna Groh, Executive Director of UST. “And now, UST Support is giving us the opportunity to assist a whole new group of organizations by providing a solution customized to meet the needs of tax-rated nonprofits.”

501(c)(3) nonprofit employers who are interested in learning if UST Support is the right program for your organization, should submit a free Unemployment Cost Analysis today!

Andrea joined the UST team just a few months ago as our newest Customer Service Representative. After working as an intern with several nonprofits while in college she said she was inspired by the work and knew she was destined to continue helping in some way – working with UST has given her that opportunity!

Andrea grew up in the local area and graduated from Cal State Channel Islands with a degree in Communication and an emphasis in Organizational Business. She continues to have a love for learning which often takes her on adventures to museums and historical landmarks in her free time. She shared that she recently took a fascination to astronomy and currently enjoys spending time at the Griffith Observatory submerging herself in the educational components offered there. She hopes to one day visit Europe, where she can create an experience where she can immerse herself in history by visiting such landmarks as the Colosseum, Brandenburg Gate, Acropolis and The Leaning Tower of Pisa.

Her favorite place to be is Disneyland which also happens to be one of her best childhood memories. You can’t replace time spent with family—making memories and there’s no better combination than a place with food, fun and laughter. She also loves watching sports, football in particular and is a Green Bay Packers fan.

Help us in welcoming Andrea to the team via Twitter @USTTrust or Facebook @ChooseUST with the hashtag #MeetUSTMondays!

By allowing nonprofits to connect directly with potential board members, Board Connect, a project of the Social Impact division of LinkedIn, aims to help you build a stronger Board of Directors that bring the ideal set of skills and expert knowledge to every nonprofit organization.

While it is only available to a select group of nonprofit organizations at this time —notably those in the fields of social entrepreneurship and education leadership— LinkedIn has dedicated a lot of time and energy to ensuring that the program is a success.

For instance, the Board Connect program provides nonprofits with free access to Talent Finder, one of LinkedIn’s premium accounts focused on finding top candidates across the site, access to an exclusive educational webcast, and an invitation to join the Board Connect Group. While participation is limited to registered U.S. nonprofits, the new program will help better connect the right people—with the right Human Resources, Marketing, and Business experience—to your organization.

Focusing on deepening relationships and cultivating connections by creating a stronger network of connections for your organization, LinkedIn bills itself as the perfect platform to connect with the people and resources every nonprofit needs to accomplish its mission.

What do you think? Is LinkedIn the right online platform to connect nonprofits with potential Board Members?

And, when the program becomes more readily available, will you consider using it to find a new Board Member? Will it significantly change your Board Membership or the methods you use to search for them?

For the past 16 years Cheryl Jones, VP, Account Executive, has fought relentlessly to help UST thrive. Responsible for all of the personal sales contacts, new business partnerships with state and national nonprofits, and the continued growth and success of the Trust, Cheryl works closely with Donna Groh, the Board of Trustees, and the 75-plus Sponsors that help make sure nonprofits across the country aware of their choices when it comes to funding unemployment.

“I’ve been in the insurance industry for more than 25 years and I jumped at the chance to work with a client whose values I identified strongly with,” explained Cheryl. “I fought hard to make Unemployment Services Trust—which was still HSUT and NNUT—my client and I still love it.

“I have always called UST my ‘Ben & Jerry’s,’ meaning that it’s a great ‘product,’ with great employees which allows you to have a lot of fun at work.”

A frequent traveler for work, Cheryl jumps at the chance to spend time at home relaxing. “I spend so much time traveling for work that when I am home I like to take it easy and be with my friends. I have been very lucky to have traveled to every state and to have met so many interesting people. I used to say that I learned geography by following the Grateful Dead around the country, but really I am thankful every day that I have a job that allows me to go places and meet so many people. I don’t know what I would do if I had to sit at my desk 5 days a week.”

Having completed her dream house in the past couple of years, Cheryl explains, “I would much rather entertain at my house than go out, so I like to use my frequent flyer miles to bring my friends and family out to see me so that I don’t have to get on another plane in my time off.”

Even her perfect weekend revolves around being close to her home, and family and friends. “The perfect weekend would be getting up and exercising then going for a walk or bike ride and having friends over for dinner; if I couldn’t do that though, I would like to be on the water either rafting, boating, snorkeling, walking along the ocean or whale watching.”

Have questions about Cheryl or want to know more about how the UST Operations Team works? Follow #MeetUSTMondays or send us your questions at info@chooseUST.org!

“I really liked the idea of supporting organizations that make a difference,” he explained.

Having served the members of UST first as an Operations Manager and then as the Director of Operations, Adam has been exposed to a whole new side of the nonprofit world while working with the Trust. But his success at easily adapting to a new challenge wasn’t unprecedented—he once had to repair his fuel line with a tire patch kit and electric tape to make it home from a camping trip in Death Valley, California—or unexpected. “I appreciate the feeling that comes with overcoming an unexpected obstacle,” he explains, “and I like having the opportunity to test myself.”

Of his move to UST, Adam recalls, “I was fascinated by the variety of organizations that were members of UST: schools, museums, zoos, assisted living centers, mental health associations, symphonies, hospitals…the list goes on and on. And I realized that my definition of ‘nonprofit’ had been really narrow.”

Taking that newfound knowledge to heart, Adam expanded his volunteer and nonprofit experience by doing work with both Habitat for Humanity and the United Way which allowed him to better “appreciate their focus on the communities that they serve.”

Growing up as part of a Navy family that moved around with his father, a career Navy man, a lot, Adam also supports and admires the efforts of programs like the Wounded Warrior Project because he recognizes the need “to honor and serve those who have sacrificed so much on our behalf.”

“One of my favorite childhood memories is having my dad surprise us by coming home early from a nine-month deployment,” he remembers.

And, in fact, family features prominently in many of his stories.

He often begins stories with “My wife…”, and even goes so far as to tell new Trust employees that she features prominently in many of his stories, so that they know who he is talking about when her name pops up. Similarly, his children feature prominently in his office, with mugs designed by them, pictures, and artwork proudly displayed. And, luckily for them, Adam jumps at the chance to learn with, and teach them something that amazes them… makes for a good story as well.

Have questions about Adam or want to know more about how the UST Operations Team works? Follow #MeetUSTMondays or send us your questions at info@chooseUST.org!

After more than 10 years with UST, Angela—who moved into a newly created position of Customer Service Representative at the beginning of the year—is still excited to talk to nonprofits about UST.

“When I first joined UST I was excited about the program and my involvement in it because it’s a unique way to help nonprofits save money. I love that our purpose is to help nonprofits across the U.S. save on unemployment costs specifically so that their own missions can be furthered!” she remembers.

Always excited to help others succeed, Angela splits her time between school, work, and volunteering at the local schools her daughters go to.

“I’m very social and I like to volunteer when I can. Throughout the year I volunteer at my daughters’ schools and help out whichever way I can, whether that means working as a classroom aide, working at the annual jog-a-thon, or helping out at the snack shack during athletic games.”

And in many ways, her desire to help others comes from early childhood experiences. “I have many fond memories of my childhood,” she says, reminiscing about her walk-in closet that was outfitted with a child-sized grocery cart, all the plastic toy foods you can think of, and a wide array of cabbage patch kids with their matching carrier, diaper bag, car seat, and stroller sets.

“Not all children experience what I had as a child, which is why I feel that it is so important to give back to our community and lend a helping hand to those with less,” she explains.

And while she’s outgrown her cabbage patch kids and the fake plastic food in her closet ‘grocery store’, Angela still loves to bake—especially around the holidays!—and take care of her friends and family. “When I’m not at work or at school, I like to spend my time with family and friends and just hang out. And I make sure to take my bulldog, Chula, on walks on the Bluffs around my house a few times a week so that we don’t forget how lucky we are to live in a place with mountains on one side and the beach on the other!”

Have questions for Angela? Want to congratulate her on the new job? Tweet us at @USTTrust!

“Even before I joined UST as the Executive Director I had known about the Trust from a previous employer and felt encouraged by what we do,” explained Donna of her earliest encounters with UST.

“While I was with my former employer, Holly Smith-Jones, my predecessor at UST, was a board member for the organization I worked at and helped us make the decision to join the Trust. I remember that I liked what UST does for nonprofits, and at the very height of the Great Recession, I saw it as a challenge to join the Trust and take it forward.”

But working with the Trust isn’t the only thing that Donna does. An avid world traveler Donna has been to all continents except for Antarctica—a blemish she hopes to remove from her wayfarer record in 2014 when she will travel from South America down to Antarctica.

When at home with her dog Murphy—a constant companion—Donna enjoys cooking and entertaining. “My daughter is always in charge of cocktails and I am in charge of the buffet.”

Describing her perfect dinner party, Donna imagines an eclectic group of people that would create a great dynamic. “The meal would be catered by Mario Batali who would, of course, also be a guest.”

“I would also invite Abby Wambach, my favorite female soccer player,” Donna said, admitting that while she was a terrible player herself, she was a decent coach.

“Then I would invite Sherlock Holmes because I love the way his mind works, and Jude Law because I like the way he looks. Clive Cussler because of his adventure stories, and David Foster who has created more hit music sensations than anyone else. Bette Midler would round out the group,” she concluded.

Prior to joining UST, Donna was the Executive Director of Toastmasters International and before that Director of Operations & Business Development for the American Association of Critical-Care Nurses. Previously she served as Vice President/COO of the Irvine Medical Center. She has a BS and Master’s degree from the University of Pennsylvania in Philadelphia and has completed coursework for an Ed.D in Organizational Leadership from Pepperdine University.

If you have questions for Donna, or want to know more about how the UST team works, follow our hashtag (#MeetUSTMondays) or send us your questions on Facebook, LinkedIn, or Twitter!

One month in…and I officially get to introduce myself for Meet US(T) Mondays!

When I first got involved with UST, I was ecstatic to help nonprofits advance their missions. My past two jobs took place at the UCSB Alumni Association and the Santa Barbara Zoo, both nonprofit organizations. Having witnessed firsthand the external and internal good nonprofits can accomplish, I figured UST was a perfect fit for me.

When I’m not working, and when I’m feeling productive, I love to bake, cook, hang out with friends, and go on beach-side runs. However, since I recently sprained my foot, my activities currently include sitting on my couch, watching reality television, and eating…a lot.

Speaking of my favorite subject (aka: FOOD), my favorite meals tend to include Mexican cuisine, pizza, or cheese in general. Since I was basically raised on fast food, my taste buds often reject most vegetables but never stop craving junk food. It’s kind of a curse, but I’m pretty content with my 8-year-old pallet.

However, my childhood didn’t just consist of Taco Bell and Pizza Hut. One of my favorite childhood memories is when my dad surprised me and took me to Disneyland on the rainiest day of the year. Although that sounds like hell to most people, the empty park, matching ponchos and endless rides on Splash Mountain made it completely unforgettable.

A close second favorite memory also takes place at Disneyland. At 5 years old, and my first visit to the park, I finally got to see Mickey…and then proceeded to knock him over in the hugging process. In fact, my family still greets me as “the girl who knocked over Mickey Mouse.” Which brings me to my next point; if I were a circus star, I would have to name myself Klutzo the Magnificent.

After breaking 4 bones (on 4 different occasions), knocking over Mickey Mouse, and rolling my ankle at my college graduation, one could make the argument that I have klutzy tendencies. And even though that’s probably true, it hasn’t stopped me from living my life to the fullest.

Want to share your clumsiest stories with me? Tweet me @USTTrust with the hashtag #MeetUSTMondays.

Sick employees are bad for business – plain and simple. They can wreak havoc on the workplace in many ways – spreading germs, putting additional stress on co-workers who have to pick up the slack or even creating tension amongst the team. While it might seem great to have such dedicated employees who are willing to work even when they are ill, what might be a mild case of the flu for one can land another in the hospital or worse, put multiple members of your team out for weeks.

You need an equitable sick leave policy in place that provides employees a reasonable amount of paid sick leave, allowing them the time to recover when they’re not feeling well. Additionally, having a clearly written policy that specifies the organization’s standards and what is expected of the employee will help to minimize sick leave abuse. Paid sick leave is not typically required under federal law but may be required under state law – different states have different requirements so make sure to do your research to determine what, if any, state laws are applicable to you.

By implementing a few simple guidelines, you can create a solid yet thoughtful sick day policy that helps to maintain a healthier workplace and keep your nonprofit running smoothing when someone is out. First and foremost, you need managers to not only encourage people to stay home when they are ill but to also stay home themselves when ill – leading by example is the most powerful tool managers have at their discretion.

Secondly, have a back-up plan in place for when those instances do arise so key tasks don’t go unattended for days at a time. For example, cross-train your staff so that everyone has someone who can fill in where and when needed. While this may not be an ideal situation for some, ensuring everyone understands the benefits of such a plan and knows what to expect ahead of time, can go a long way in eliminating some of the stress when the need presents itself.

Also important to keep in mind, while it’s not practical to have someone out of the office for weeks due to a general cold, it is wise to require employees who have been out with the flu and/or a fever to remain home until they’ve been symptom-free for at least 24 hours. This will ensure they are no longer contagious and getting others sick upon returning to work.

If an employer doesn’t offer sick leave, they will only accelerate health issues and the spread of illness, thereby lowering productivity and office morale. Remember, when an employee comes to work sick, it puts you and the rest of your staff in a weak environment, which can affect a nonprofit as badly as the loss of a major contributor. Being sensitive to the health of all your staff should be priority number one. To ensure you are doing everything you can is to genuinely take an interest in the health of the people working with you. Remember, a healthy workplace is a productive workplace.

What Will Affect My Organization During Unemployment Peaks?

The Number of Employees at your Organization. Since smaller organizations may have made smaller contributions into the state-run UI trust fund, even one benefit claim can have a significant impact on the organization’s future experience rating.

The Filing Date of the Benefit Claim. The filing date of a claim determines the base period which determines the former employee’s wages that will be used to calculate their UI benefit payments. In the majority of states, the base period is the first four of the last five completed quarters worked.

For example, if Sally H. worked for Organization ABC from December 2004 to January 2013, and filed a base period claim in February 2013, your organization would be charged for her UI benefits based on her wages from 4th quarter 2011 to 3rd quarter 2012 (or approximately Oct. 2011- Sept. 2012).

The Amount of Wages the Employee Earned. Like most taxable areas, the higher the wages your former employee earned, the higher UI benefits they’ll receive once approved. And, in turn, the more high wage earners you have with high benefit payments, the faster your organization will see an increase in employer taxes.

The Amount of Benefits Paid to a Former Employee. Whenever employees stop receiving benefits before the full amount runs out—usually because the employee has found a new job and stopped collecting—it positively effects your experience credit and tax charges.

It is important to note however that not all employers are subject to paying unemployment taxes and some, like 501(c)(3) organizations with 10 or more employees, have alternative cost saving options available to them that can help reduce the price of unemployment at their organization. To find out if a better option exists for your organization, contact us at info@chooseUST.org or request a complimentary Savings Evaluation today.

Want more information? Send us your questions on Twitter, LinkedIn and Facebook!

What Will the Unemployment Office Look at When Determining the Eligibility and Cost of a Claim?

The Type of Employer your Organization Is. A few nonprofits are not required to pay unemployment claims under IRS tax code 501(c)(3). But if you have employed four or more individuals in some portion of a day in each of twenty different calendar weeks, in either the current or preceding calendar year, you must pay into the unemployment system, and your employees are eligible for benefits. Regardless of whether you are exempt or not, it is highly encouraged because it provides financial security to your employees should they lose their job through no fault of their own. If your organization is required to pay (or reimburse) the state for unemployment claims, the unemployment office will continue examining the claim to determine the eligibility of your former employee.

The Type of Employee Involved. Not all employee types qualify to collect unemployment benefits. For example, part-time workers or independent contractors may not qualify for unemployment benefits. However, if an employee is misclassified or other errors occur during the claims review process your organization may be held responsible for benefits paid to the former employee.

The Number of Places the Employee Has Worked. If a former employee worked for several employers within the base period*, the charge to your organization—and the effect it will have on your taxes—may be less because it would be split among all of the employers identified in the base period claim.

The Length of Time the Employee Worked at your Organization. The longer an employee has worked at your organization, the more likely it is that your agency will shoulder the brunt (and eventually all) of the base period claim effects.

The Nature of the Employee Separation. Whenever a new benefits claim is filed, the unemployment office determines whether or not a former employee meets eligibility requirements to collect benefits under state law. In some cases, the unemployment office may determine to provide benefits to an employee you don’t think should collect based on the nature of the separating event, and your organization is able to contest these at an unemployment hearing. Proper documentation is crucial to winning the case so you must be prepared, and some nonprofit trusts like UST will even provide you with a case representative to help you with court cases. (Nonprofits who used a hearing representative had a 72.3% win rate compared to 57.4% for employers who did not**).

It is important to note however that not all employers are subject to paying unemployment taxes and some, like 501(c)(3) organizations with 10 or more employees, have alternative cost saving options available to them that can help reduce the price of unemployment at their organization. To find out if a better option exists for your organization, contact us at info@chooseUST.org or request a complimentary Savings Evaluation today.

Want more information? Send us your questions on Twitter, LinkedIn and Facebook!

Missed a Part? Read Part I here. Read Part II here.

* Base period claims are those in which a claim form is sent to EACH employer for which the claimant worked during his base period (usually the first four of the last five completed calendar quarters immediately preceding the beginning of a claimant’s benefit year). So if your former employee is hired for only a short duration by another employer, you both may liable for a portion of their benefits.

** Source: Equifax Workforce Solutions

Aron joined the Unemployment Services Trust in mid-April as a UST Account Specialist and is excited to be working directly with a vast variety of nonprofit organizations. Fittingly, one of his favorite quotes is “Be the change you want to see in the world” which makes him a great addition to the UST team.

Outside of the workplace, Aron enjoys working out and Python coding, a general purpose programming language created in the late 1980’s that is used by thousands of people to do things from testing microchips to building video games. He also does his own shopping and cooking which is fitting since food came up a lot during our Q&A. His favorite holiday is Thanksgiving and not coincidently, his favorite childhood memory involves food – he shared, “it was the first time I was given a whole torta all to myself.”

When asked what TV show his life emulates, he said General Hospital, explaining “Everyone has heard of it and knows about it but no one really knows who’s in it or what it’s about.” An exciting adventure in his life story would be a visit to the Nurburgring Race Track in Germany where high performance cars are tested for speed but open to the public for those with an adventurous side – a place Aron has wanted to visit for some time.

Help us in welcoming Aron to the team via Twitter @USTTrust or Facebook @ChooseUST with the hashtag #MeetUSTMondays!

This option, which has been available exclusively to 501(c)(3) organizations since 1972, allows nonprofits to stop over paying into their state tax-rated system and offers substantial long-term savings for those employers who choose to become direct, or self-, reimbursing agencies.

“Our state has increased its costs to most employers so I’m shocked that not all nonprofits are looking at this option,” said one study participant who has already opted out of their state unemployment insurance system.

By opting out of the state tax-rated system, which typically causes employers to pay $2.00 in taxes for every $1.00 in actual benefits that is paid to their former employees, most nonprofits are able to save money and do significantly more with their budget.

“It wasn’t until after my first full year with UST that I started to believe it was not too good to be true. We received our audit and a refund and I thought ‘Wow, we really have a credit here,’” wrote another study participant.

Offering valuable savings in both the short and long-term, opting out of the state system does have several drawbacks for agencies that elect to become direct reimbursing without joining a trust like UST or other program.

“I’m always looking to save money and get more services for my clients,” said one nonprofit HR consultant, “I push the idea of UST for giving them an added resource. [With UST] They’ll have somebody on their side who can help them.”

To read the online press release about the Division’s findings, go here.

All information and quoted materials were pulled from a study conducted at UST, which was released at the end of the 1st quarter of 2012. The study surveyed almost 300 nonprofit agencies to identify key data about how nonprofits understand and utilize their unemployment tax options

Read the previous article here.

Now that their August report is wrapped up, states struggling to rebuild their workforces say they know better than the federal government how to make the most out of the limited amount of workforce development and job training dollars in their own state. In particular, the NGA is asking for an increase in monies allocated to “set-aside” funds from the Workforce Investment Act that states are able to use at their own discretion to explore new approaches to workforce development tailored to their states’ needs.

Read more about what the NGA recommended, and what their critics say to counter the report, at Stateline here.

And tell us, who do you think should control the bulk of workforce development monies: the state, the Feds, or local governments? Share your answers on Twitter, Facebook, or LinkedIn.

by Guest Blogger Barry T. Omahen, CPA, Managing Partner, Lindquist LLP Certified Public Accountants

The American Institute of Certified Public Accountants (AICPA) has issued new standards that may impact your future audit engagement. Statements on Auditing Standards (SAS) Nos. 122–125 (referred to as “Clarified Auditing Standards” or “Clarity Standards”) introduce changes that go into effect for financial statement audits for periods ending on or after December 15, 2012. For most entities, that means the standards will be effective for the year ending December 31, 2012, or later.

Some changes may affect all audit engagements

Certain changes may only apply in unusual circumstances

Some of the benefits of the clarified auditing standards include enhanced communication between your team and your auditors, improved audit quality and increased confidence in the audited financial statements.

These new standards will require auditors to redo much of the system evaluation work and memorandums that they carry forward from one audit to the next. As such, it’s encouraged that you work closely with your auditor to make these changes as smooth and efficient as possible!

For a more detailed version of this article, refer to Lindquist LLP’s website: http://www.lindquistcpa.com/AICPA-Audit-Clarity-Standards-11092012.htm

Barry T. Omahen , CPA, is Lindquist LLP’s managing partner based in the firm’s San Ramon office. Barry specializes in serving the audit, accounting and reporting needs of not-for-profit organizations and employee benefit plans. He serves as the partner in-charge of the firm’s quality control review and audit and accounting practice. He can be contacted at (925) 498-1546 or bomahen@lindquistcpa.com .

Lindquist LLP provides this information for general guidance only. It does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax articles are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

When seeking a new job opportunity, your goal is for your resume to capture the attention of a busy recruiter and for them to bring you in for an interview. In order for this scenario to take place, you need to understand the day in the life of a recruiter.

Recruiters will receive hundreds, maybe even thousands, of resumes making it quite impossible for them to go through each one. The line-by-line method is difficult to achieve when receiving such a large volume of resumes, as there just isn’t enough time in the day. In the nonprofit sector, this can pose as an even bigger challenge. With some nonprofits not having a designated HR team—maybe one HR employee at most—this can make reviewing resumes very time consuming and burdensome.

When a recruiter is reviewing a resume, his or her eyes are moving down the page in a Z-pattern—left to right all the way down. They’re looking for certain key terms that relate to the job they’re trying to fill. This first pass is called the Six Second Skim Test. If a recruiter comes across what he or she is looking for in that first pass, your resume will likely get a shot at a more in-depth resume review. And, if they still like what they see, you might even get a phone call asking you to come in for an interview.

In order to pass the six second skim test, formatting can make all the difference. Showcasing your key skill sets and keywords that relate to the job for which you’re applying, can make you stand out from the rest. Adding these simple key changes can significantly improve the chances of your resume getting noticed.

Nonprofit organizations have to use their time as efficiently as possible, making this six second skim test a useful tactic to incorporate when recruiting and hiring future candidates.

If you don’t know the answer to both of these questions, it might be time to take a look at how traditional job evaluations are giving way to salaries that are now based on market pricing and a little flexibility.

Turning away from traditional job evaluations that looked at job ranking, job classification, point factor, and factor comparison, many newer job evaluation tactics take into account the fact that people are more fluid in their careers and no longer care how their job is evaluated—so long as they’re being paid fairly. New salary determination methods also take into account that you should never pay more than the job is worth to you.

For nonprofits, especially those where employees give their all to change the status quo and to make a difference for your mission determining salary scales based on market pricing might not be a bad idea.

But nonprofit market pricing doesn’t always compare to the for-profit side where employees may have an easier time paying off their cars, homes, and bills, as well as enjoying that extra dinner out and more vacations.

When you’re ready to set salaries for your nonprofit staff, make sure that you (and Human Resources) know:

After determining those, it’s time to evaluate the pay structure of your nonprofit employees using a base job salary and base area salary.

Because more jobs are opening up in the for-profit sector—jobs that can often afford to pay employees higher salaries with better benefits and more stability—it’s important that you take into account more than just what job surveys suggest is a fair salary range. Consider questions that look at your employee’s health and happiness while doing this—i.e. would $1500 a month pay the rent or mortgage for your volunteer manager? Would they be able to afford their base bills too? Or would they be left commuting long hours because they couldn’t afford area rent? Do you know how that would affect your agency?

State economic development offices and regional development agencies can help provide up-to-date and accurate state and regional pay information that can then be broken down by skill level and neighborhoods. The U.S. Department of Labor maintains a similar database that can help you determine fair pay scales for your employees.

Your best resource is always other area nonprofits though. Although they might not cover the same mission that you do, other nonprofit employers can help you determine if your pay scale is fair. All you have to do is ask a few of the right questions!

Consider asking these questions in addition to those you think of on your own:

Utilizing State-Specific Unemployment Claims Administration, UST Participants Save More than $26.2 Million on Unemployment Claim Costs.

Founded by nonprofits for nonprofits— UST, a program dedicated to helping nonprofits reduce paperwork burdens and protect assets, today announced it has identified $24,950,103 in unemployment cost savings plus an additional $1,259,711 in errors that are refunded to UST participants.

For 35 years, UST has been helping 501(c)(3) organizations exercise their exclusive nonprofit tax alternative, as allowed by Federal law, to pay only for their own unemployment claims which can save them thousands annually. Because they are no longer subsidizing for-profit companies in the state tax system, and are receiving expert claims guidance, UST members can efficiently manage their unemployment claims while mitigating liability.

UST participants are able to efficiently combat improper unemployment claims, meet important deadlines and prepare for claims hearings by utilizing their state-specific claims representative—helping them to avoid costly penalties while offsetting the administrative headache. UST’s claims administrator equips more than 2,200 participating nonprofits with the guidance and resources they need to confidently manage their claims process.

“Being in the nonprofit sector, employee bandwidth and funding can often be stretched thin and UST is able to provide its members with significant funds in these times of need,” says Donna Groh, Executive Director of UST. “Helping to filter this money goes right back into the nonprofit community—strengthening the missions’ of nonprofits—is what the UST program is all about.”

Whether you’re a tax-rated or reimbursing employer, UST can help protect your funding and simplify your claims management processes. If you’re a 501(c)(3) looking for ways to help your nonprofit save money for 2019, benchmark your unemployment costs by filling out a free Unemployment Cost Analysis form by November 15.

By categorizing an organized nonprofit sector to include the number of nonprofits per capita in each community and the degree to which nonprofits directly engage local residents, the study, “Civic Health and Unemployment II: The Case Builds,” presented three key findings:

Further emphasizing the importance of an organized nonprofit community that is involved with those in the local area, the study suggests that while nonprofits directly contribute to a lower unemployment rate by creating jobs, there also appears to be a ripple effect in which organizations that engage with local residents create a change in the local unemployment rate.

Released by the National Conference on Citizenship this study may well become highly influential for those who most often are called upon to discuss the importance of establishing strong nonprofit sectors. And although it doesn’t offer all the answers as to why organized, involved nonprofits are able to directly impact unemployment rates, there will undoubtedly be more information to come in the next few months as the unemployment rate continues to trend downward.

Like many states desperately trying to save their funds from insolvency, legislators in New Mexico passed a bill last year that would have slashed unemployment benefits and hiked the premiums businesses still in the tax-rated state system would have to pay. Martinez, however, eliminated the higher premiums and signed a new bill this year that approved lower rates through 2013.

Senator Gerald Ortiz y Pino (D- Albuquerque) is warning, though, that the state will soon have to borrow from the federal government at a high interest rate because employers only paid $197.8 million into the fund last year. And with more than 40,000 employers drawing from the fund, the remaining $60 million won’t go far.

For nonprofit agencies still in the state system, there are other options, such as leaving the state to join a Trust, like the Unemployment Services Trust (UST), that can help save more money and gain greater predictive control over yearly budgeting.

In fact, New Mexico nonprofits that leave the state system and join UST save an average of $3,483 a year.

To learn more about your opt out alternatives, visit https://www.chooseust.org/501c3-unemployment-alternatives/ or sign up for the an upcoming Exclusive Nonprofit Savings webinar.

Read the full Albuquerque Journal article here.

Over the years, nonprofits have become more willing to incorporate different elements of technology into their organization—encouraging growth, utilizing the strengths of a smaller bandwidth and increasing brand awareness across multiple channels. Technology has opened many doors for nonprofits along with offering new approaches to communication with their target audience and encouraging more community-driven efforts. However, nonprofits tend to have a difficult time with incorporating an innovation with the technology element—the two don’t always see eye to eye.

An effective innovation may not always require your organization to spend a large sum of money in order to make it work. To find success in your innovation, nonprofit leaders need to realize innovation can be a risk, however knowing some of the issues that your organization may face can better prepare you when applying a new technology. And because of budget restraints, innovation tends to happen less creating certain limitations on what can be done.

Often times, nonprofits receive free or discounted software, however some hesitate to take the time or to make an investment into the initial set-up, continual maintenance or the training of staff on how to use the tool. This tends to cause more problems than offering any actual benefit to the organization. Incorporating new forms of technology can offer some economical approaches for organizations that can help them avoid major setbacks and offer effective implementation for certain tech tools.

While bringing on new forms of technology has it’s challenges, there are some ways to combat these issues and make it worth your time and money. First, having an actual plan in place can help you better understand the needs you want to meet and meet deadlines within your timeline. Second, while a tool may be free, it may not be the best fit for what your organization needs. Finding a tool with a better value will be more beneficial in the long run, even if it costs a little more money. Lastly, be sure to set aside time to train your staff on how to properly use the tool—expecting your staff to just figure it out can lead to frustration or the possibility for future errors.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

According to Doug Holmes, President of UWC – Strategic Services on Unemployment & Workers’ Compensation:

“On February 22, 2012, the President signed P.L. 112-96, The Middle Class Tax Relief and Job Creation Act. This legislation extended and reformed the Federal Emergency Unemployment Compensation (EUC) program for the remainder of 2012, which was subsequently extended through December 2013. This legislation also included landmark reforms to the permanent unemployment program, such as creating new job search requirements for Federal benefits, permitting States to have new flexibility to seek “waivers” to promote pro-work reforms, allowing States to screen and test certain UI applicants for illegal drugs, requiring “reemployment eligibility assessments” (REAs) for the long-term unemployed, and requiring States to recover more prior overpayments of UI benefits. The initial implementation of these 2012 reforms was previously explored during a Human Resources Subcommittee hearing in April 2012.”

“In announcing the hearing, Chairman Reichert said, ‘Fourteen months ago, Republicans and Democrats in the House and the Senate agreed on commonsense reforms to the unemployment insurance system designed to help more Americans return to work sooner. The President signed those policies into law, but the Administration has since been selective in implementing some policies and has created barriers to successfully helping states take action on other policies. This hearing will help us evaluate how the Administration has implemented the 2012 reforms and determine what we can do to help more Americans collect paychecks instead of unemployment checks.’”

UWC provided testimony and advocated in favor of the integrity provisions in the legislation in 2012, many of which were adopted. UWC testimony from the April 25, 2012 hearing in review of implementation can be viewed here.