The Department of Labor (DOL) provides a short overview of the program on their website, and summarizes it by saying: “Unemployment Insurance is a federal-state program jointly financed through Federal and state employer payroll taxes. Generally, employers must pay both state and Federal unemployment taxes…However, some state laws differ from the Federal law and employers should contact their state workforce organizations to learn the exact requirements.”

The program itself works to provide jobless workers who have lost their job through no fault of their own with temporary, partial wages while they search for a new position. For more information on how unemployment insurance works, read our more complete overview on the state program.

Is Your Nonprofit Liable?

501(c)(3) nonprofits are exempt from federal unemployment taxes, but may be liable for state contributions if they meet something called the “4 for 20″ provision. This provision is triggered when four or more individuals are employed on the same day for 20 weeks in a calendar year, though not necessarily for consecutive weeks. It is important to note that who is considered “employed” for these purposes is not always straightforward – see Independent Contractors below.

Why Independent Contractors May Still Be Considered Employees

There are different rules and tests used by government organizations to determine independent contractor status, because different organizations are responsible for separate aspects of law. For the purposes of unemployment insurance, the Department of Labor uses something called the “ABC test”, which makes it sound simple, but is more complicated when applied to real situations.

The ABC Test establishes criteria that an work relationship must meet in order to for the services of that individual to not be considered employment. The three parts of the ABC Test relate to employer control/direction of the worker, place(s) of business or courses of business, and proof that the worker is independently established in the trade. A nonprofit may have to pay unemployment taxes even if the IRS or their state revenue services determine that, for income tax purposes, individuals may be independent contractors.

Cost-Saving Alternatives

The Unemployment Services Trust (UST) provides an alternative to paying into the state unemployment tax system, and can be a cost-saving option for nonprofits with more than 10 employees. Through UST, organizations directly reimburse the state only for the claims of their former employees, rather than paying the state unemployment insurance tax which covers all employers throughout the states.

And, because keeping unemployment costs low is vital to so many organizations across the U.S., we’ve added state-by-state information for taxable wage bases from the Department of Labor so you can see where your organization falls on the tax scale.

We encourage nonprofits to be proactive in learning what their options are, and what types of unemployment tax alternatives best suit their needs. Complete a complimentary Savings Evaluation to see if your organization could save money on its unemployment costs.

This post does not constitute official or legal advice. A version of this article originally appeared on blog.nonprofitmaine.org by Molly O’Connell.

Over the next several weeks 521 nonprofit members of the Unemployment Services Trust (UST) will receive a combined $8,762,873 in cash back. In total this brings participant savings over the past year to more than $43 million in claims savings, audited state returns, and cash back.

“One of the most exciting times of the year at UST is when we get to tell members that they will be receiving money back,” said Donna Groh, Executive Director of UST. “For members that elect to take the cash back as a check this money often helps them expand important initiatives. And, learning the exact impact that each dollar we’re able to save, and return, to nonprofit employers helps motivate us to find even more ways to lower unemployment costs across the board for our members.”

The UST program, which helps nonprofits with 10 or more employees control unemployment-related HR costs, includes an annual review of its 2,000+ nonprofit accounts–using an advanced actuarial model. Unlike the state unemployment tax system or some private insurance where taxes and premiums cannot be refunded (even when benefits paid out are far below what the employer paid in), UST instead allows for cash back when an organization has a positive unemployment claim experience.

UST members whose claims were lower than anticipated, and that are well-funded for future claims, will receive a direct refund or credit to their nonprofit organization.

“Hearing the individual stories about what members plan to do with their cash back is extremely rewarding, and allows us to better emphasize the mission-driven impact of becoming part of the UST program,” seconded Adam Thorn, Director of Operations.

By aiming to ensure that a nonprofit is properly reserved for unemployment claims costs, but not holding excess funds beyond the necessary cushion for future claims, UST helps serve its mission of “Saving money for nonprofits in order to advance their missions.”

To learn more about the UST program for 501(c)(3) employers, visit www.ChooseUST.org or call (888) 249-4788 to speak with an Unemployment Cost Advisor.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

This newest partnership will allow U.S. based organizations with a 501(c)(3) tax designation to more effectively take advantage of the federal law that allows nonprofits to opt out of the state unemployment tax system. By paying only the dollar-for-dollar cost of unemployment benefits paid to former employees, organizations that join UST lower their average claims cost to just $2,287 per claim versus the national average of $5,174 per claim.

“The ultimate goal of each and every nonprofit association that we work with is to provide their members with the best opportunities to advance their missions. By combining the power of hundreds, and sometimes even thousands, of smaller nonprofits, associations are able to get better money saving tools customized for their members,” said Donna Groh, Executive Director of UST.

“Last year we found more than $3.5 million in tax savings for nonprofits that came to us through our association partnerships. This year we want to double that and find at least $7 million in tax savings for our affinity partners’ member organizations.”

About the Alliance for Children and Families: The Alliance is a national organization dedicated to achieving a vision of a healthy society and strong communities for all children, adults, and families. The Alliance works for transformational change by representing and supporting its network of hundreds of nonprofit human serving organizations across North America as they translate knowledge into best practices that improve their communities. Working with and through its member network on leadership and advocacy, the Alliance strives to achieve high impact by reducing the number of people living in poverty; increasing the number of people with opportunities to live healthy lives; and increasing the number of people with access to educational and employment success. For more information, visit Alliance1.org. About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

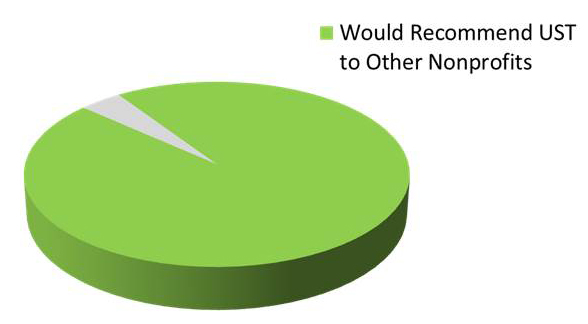

The Unemployment Services Trust (UST) is proud to announce that 96 percent of current participants would recommend the program as a valuable cost-saving opportunity for nonprofits. UST credits the improvement over last year’s 93 percent recommendation rate to an intense focus on the overall member experience and greater attentiveness to members’ needs.

“From the very beginning, the UST program was designed to support nonprofits by reducing the time and cost associated with managing an unemployment claim,” said Donna Groh, Executive Director. “To have found that our members would overwhelmingly recommend our service to other nonprofits is extremely rewarding.”

“We’ve worked hard to improve our customer service model and increase the quality of interactions that our customer service team has with our current members over the past year,” said Adam Thorn, Director of Operations. “By incorporating best practices and higher customer service standards, we have been able to support more in-depth interactions with our members, whether that means providing more detailed responses to questions or better educating organizations about the benefits of reimbursing for unemployment claims versus paying taxes.”

“On the heels of this increase in customer service standards was the increase in direct savings that our members experienced last year as well,” said Groh in reference to mitigated unemployment claims costs and cash back to participants.

Last year, UST was able to help members mitigate $32,598,054 in unemployment claims through best-in-class claims management. The same claims management services allowed UST to return an additional $1.7 million of charges made in error by state unemployment offices, which were audited by UST and credited back to the individual organizations.

Select participants also received $11,041,738 in cash back after their reserve accounts were reviewed for positive claims experience.

Her drive and passion to spread awareness within the community makes her a great fit for the UST team. Laurie explains, “I am not doing any volunteer work currently, but when my father passed away from cancer 10 years ago, one of the ways I got through it was to get involved with the American Cancer Society’s Relay for Life fundraisers in Ventura.”

Outside of the office, Laurie and her husband are adjusting to life as newfound puppy parents. They’re rescue puppy, Watson, is a Dachshund/Corgi mix and makes a wonderful addition to their household.

When given the opportunity, Laurie can’t resist the tranquility of nature. “Camping is probably my favorite thing to do and my husband and I go at least twice a year – sometimes more,” she says. “My favorite camping trip was years ago with my sister and some friends and we went on a 50 mile (2 ½ day) river rafting trip on the Colorado River from Grand Junction, CO to Moab, UT…definitely one of the best trips I’ve ever been on!”

In addition to being a dog lover and camping enthusiast, Laurie likes to let loose with a little help from her buddy, Bruce. If her life was a TV show, Laurie would select Growin’ Up by Bruce Springsteen as a theme song that played every time she walked into a room. “This represents the music I grew up with and sometimes I don’t think I’m finished growing up.”

Are you a fan of Bruce Springsteen too? Tell Laurie about it @USTTrust with the hashtag #MeetUSTMondays!

Since the Great Recession took its initial toll on the state unemployment insurance (UI) funds, states across the U.S. have gone into considerable debt in order to provide benefits for millions of unemployed. Trying to combat unemployment costs while restoring their debt with the federal government, many states look towards alternative measures to repair their financial foundations.

In 2011, states accumulated a debt of over $47 billion owed to the federal government– the peak of the United States’ economic deficit. While the federal debt has since decreased, with 16 states still owing over $21 billion at the beginning of 2014, a lot of states took out private loans to avoid an automatic increase in their federal unemployment tax on employers.

With a low UI trust fund balance, many states have been forced to cut their unemployment benefits, rather than borrowing additional money from the government. Other alternative methods used to reach state solvency include:

Such actions were meant to diminish volatility and recover sensibly from the impact of the debt.

While the states have steadily reduced the debts triggered by the Great Recession, the U.S. has a long way to go before they achieve full economic restoration. And employers will continue to see their overall cost of unemployment steadily rising, if their state is to both recover and prepare for the next downturn.

To see how your state unemployment insurance trust fund debt compares to other states, view Stateline’s chart here.

Learn more about how the U.S. is affected by the unemployment trust fund debt here.

An analysis by UWC- Strategic Services on Unemployment & Workers’ Compensation reveals that a number of states have state UI trust funds that are so insolvent they are unlikely to recover before the next recession. For employers in these states (listed below) it can be expected that state and/or FUTA tax rates will continue to rise with longer term restrictions being imposed on benefit increases alongside enhanced integrity efforts.

While some states have elected not to maintain a large trust fund balance and are relying on “just in time” supplemental funds to assure their solvency, many are using bonds to supplement UI taxes and remain strained.

States not meeting the 0.5 Average High Cost Multiple threshold as of December 31, 2013 include:

Alabama, Arkansas, Arizona, California, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Kansas, Kentucky, Massachusetts, Missouri, North Carolina, New Jersey, Nevada, New York, Ohio, Pennsylvania, Rhode Island, South Carolina, Texas, Virgin Islands, Virginia, Wisconsin, West Virginia

States that do not meet the DOL recommended levels but have average High Cost Multiples of 0.5 or more include:

Colorado, DC, Hawaii, Maryland, Maine, Michigan, Minnesota, Puerto Rico, Vermont

States that have solvent UI trust fund balances according to the US DOL 1.0 Average High Cost Multiple formula include:

Alaska, Iowa, Idaho, Louisiana, Mississippi, Montana, North Dakota, Nebraska, New Hampshire, Oklahoma, Oregon, South Dakota, Utah, Washington, Wyoming

The relationship between HSC and UST will allow many more 501(c)(3) organizations to learn how to lower the cost of unemployment at their organization by opting out of the state unemployment insurance tax system and implementing best practices. By paying only the dollar-for-dollar cost of unemployment benefits awarded to former employees, organizations that join UST lower their average claims cost to just $2,287 per claim versus the national average of $5,174 per claim.

“Not only will this new partnership result in potential savings for HSC members,” explained Judy Zangwill, Executive Director of Sunnyside Community Services, who sits on the Board of Directors at HSC and is also a UST Trustee, “but there are also additional benefits in terms of gaining access to the ThinkHR hotline and training, and getting 100% representation at all unemployment claim hearings when an organization joins UST.”

“As a Trust member I knew that UST helps nonprofit organizations from the time an employee initially files for unemployment benefits to the end of the claims experience. But as a UST Trustee I have even greater insight into the program and can see that it’s not only efficient for members, it’s also a well-run organization that provides increased value for its 80 Affinity Partners.”

About the Human Services Council: HSC strengthens the not-for-profit human services sector’s ability to improve the lives of New Yorkers in need through networking, advocacy, research, media education and by acting collectively to establish greater balance between organizations and government. As a membership association HSC has long been at the forefront of enacting positive changes to outdated, bureaucratic governmental systems that human services providers must navigate to help those in need. In service to their members, HSC seeks to reduce regulatory burdens while strengthening accountability—with the overall goal of producing better outcomes for clients. Their efforts enhance public recognition of the sector, improve its financial stability, and have a long-term positive impact on the well-being of New Yorkers in need. For more information, visit humanservicescouncil.org.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

Every day is Earth Day for nonprofit members of the Unemployment Services Trust (UST) who are reducing their paper trail. More than 91% of the organizations that participate in the UST program now handle the details and filing of their unemployment claims online. 68% of UST members are participating in the online unemployment claim dashboard that allows them to view claims detail related to their organization and process information requests from the state. And an additional 23% of UST members have elected secure email channels as their method of claims response, further eliminating paper waste and increasing the speed of communication.

“This green initiative is our small way of contributing toward reducing our carbon footprint, and also making life easier for our nonprofit members,” says Adam Thorn, UST’s Director of Operations.

Thorn explains, “Last year the federal government mandated that state penalties should be imposed if an employer does not respond in a timely manner to the state’s request for information on an unemployment claim. The response window is often a week or less, so being able to e-file claims information helps mitigate the risk of non-compliance and helps us be a more eco-friendly program. It’s a win-win.”

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

Unfortunately, for many states, the realization came a little too late.

During the height of the Recession, almost 40 states borrowed a combined $50 billion from the Federal Unemployment Trust Administration (FUTA) to continue providing jobless benefits. This much debt required many states to make long-term changes to their unemployment systems by either charging penalties or fees to businesses or by cutting jobless benefits. Many made historic cuts to the number of weeks of aid available, but some—like New Jersey which racked up more than $1.5 billion in debt—took a long, hard look at the administration of their trust.

In New Jersey that long, hard look at the administration of their unemployment trust fund resulted in some spectacular results. Over the past four years New Jersey has identified more than 300,000 people who tried to wrongly collect benefits through identity theft, failure to report a new job, schemes, and honest mistakes. Also:

But what did New Jersey do that set them on the path to successfully rebuild their unemployment trust fund?

They updated their system.

Namely, they began using a strategy referred to as ‘identity proofing.’ With the help of LexisNexis, the state of New Jersey requires applicants to verify a wide range of personal information through a quiz on the state labor department’s website. The questions are specifically developed to be ones that the individual who owns an identity could accurately answer.

Then, using the billions of public records that LexisNexis collects, the answers—which range from what kind of car an applicant has, to who lives at their address—help weed out potential frauds.

Less than a year-and-a-half into the effort, more than $4.4 million in improper payments have already been stopped, and almost 650 instances of identity theft have been avoided.

Want to know how well your state is catching improper payments? The U.S. Department of Labor provides this state-by-state breakdown for 2013.

Read more about how New Jersey is fighting improper payments and unemployment fraud here.