As a nonprofit leader, you have an obligation to approach “harassment” with three key factors in mind— prevention, investigation and willingness to address. Investigations of harassment in the workplace can come in many shapes and sizes, meaning they can originate from a wide variety of topics—such as discrimination, substance abuse, harassment or workplace safety. While each investigation can be different and may have different formalities attached to it—standards should be in place to ensure a thorough investigation is applied to each incident.

It is important to respond immediately when an allegation of harassment surfaces. This can help prevent any new acts from taking place and will help with maintaining the trust of your employees. At the same point, you should be reaching out for professional guidance to ensure that all aspects of a harassment claim is carried out appropriately—reaching out to your insurance carrier to provide a “notice of a potential claim.” This is a common move for nonprofits since the insurance company can offer resources and the expertise of legal counsel. Another option is hiring a third-party human resource firm that has experience with handling harassment investigations. Lastly, a nonprofit may decide to handle the investigation in house utilizing its’ own staff with guidance from various legal resources.

Each investigation should be handled promptly, documented, thorough and remain confidential. Your nonprofit should always aim for consistency and consider how to best provide “due process.” This also includes, informing those involved with the outcome of the investigation once it has concluded. Being transparent about the outcome, actions or steps being taken to address a situation, will give your nonprofit the opportunity to demonstrate follow through of its own policies, while remaining confidential and maintaining privacy for those involved.

As a nonprofit, you are required to maintain the safety of your employees by creating a safe working environment—and with that comes the responsibility of acting promptly when approached with a harassment claim. Whether it’s the CEO or an associate being investigated, it should be carried out in the same manner and properly conducted. This will determine that the appropriate policies are in place and encourage fair outcomes for all employees involved.

Employers added 157,000 jobs in July and the unemployment rate went down to 3.9 percent making the number of unemployed people decline by 284,000. At the end of July, the total number of people unemployed is now at $6.3 million.

In July, the number of long-term unemployed was unchanged at 1.4 million, which accounts for 22.7 percent of the unemployed. In addition, the number of persons employed part time for economic reasons—also referred to as involuntary part-time workers—changed slightly in July, at 4.6 million, but has been down by 669,000 over the course of the year. These individuals, who would have preferred full-time employment, were working part time because of their hours being reduced or they were unable to find full-time jobs.

America increased employment in professional and business services, manufacturing, health care and social assistance sectors. In professional and business services, there was an increase of 51,000 jobs in July making an overall increase of 518,000 over the course of the year. In the manufacturing sector, there was 37,000 jobs added with most of the gain in durable goods. There was a rise in transportation equipment (+13,000), machinery (+6,000) and electronic instruments (+2,000). Over the past 12 months, manufacturing has added 327,000 jobs in total. Lastly, employment in health care and social assistance rose by 34,000 and with an upward trend of +17,000 jobs in health care employment this past month, the number of jobs has totaled 286,000 since the beginning of the year. Hospitals and social assistance added 23,000 jobs during the month of July.

The average hourly earnings for all employees on private nonfarm payrolls rose by 7 cents to $27.05. Over the year, average hourly earnings have increased by 71 cents, or 2.7 percent. Average hourly earnings of private-sector production and nonsupervisory employees increased by 3 cents to $22.65 in July.

Each year, the establishment survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. The Bureau of Labor Statistics (BLS) will release this preliminary estimate of the upcoming annual benchmark revision on August 22 at 10am.

Are you frequently overwhelmed by your workload and flustered by the chaos that your desk has turned out? You’re not alone. Many of us feel buried every now and then – it’s your busiest time of year, there’s new mail, invoices and or reports that end up on your desk every day and before you know it your desk looks like a tornado swept through it. The problem isn’t so much that your desk is messy but that important stuff gets lost. Beyond efficiency, the strain of disorganization can add unnecessary stress to your work day and cause mental exhaustion.

Reason dictates that those who are unorganized cannot be as efficient or as productive as those who are. There are some however, that know exactly where everything is. Some people may feel that a cluttered desk makes they appear busier while others feel a clean desk shows how efficient they are at getting the work done. Either way, the key is to work in a manner that allows you to be the most effective.

Whether you want a white glove worthy desk or just to bring some order to your work area, utilizing these simple tricks will get you on track in no time at all.

If you are like most of us, you are going to spend the majority of your day at work. It’s essential to your organization and sanity to make your work space work for you so that it maximizes your efficiency.

UST is giving 532 nonprofits $3,869,249 in cash back for their ability to reduce their anticpiated unemployment claims within the year.

UST, a program dedicated to providing nonprofits with workforce solutions that help reduce costs so that they can focus more on their missions, announces that it will be dispersing $3,869,249.80 in cash back to more than 532 of their program participants. After accruing all of their claims savings, audited state returns and cash back throughout the last year, UST members will have $30.1 million filtered back into their nonprofits’ pockets.

UST aims to provide 501(c)(3) nonprofits with the latest HR training, outplacement resources and unemployment claims management tools they need to stay compliant with the state and federal laws, while also helping to reduce paperwork burdens.

One of UST’s most popular programs, UST Trust, helps reimbursing employers build a reserve—protecting their money on the front end—so they don’t experience the steep ups and downs in their cash flow due to unexpected unemployment claims. Unlike their for-profit counterparts, UST Trust participants can receive cash back through UST when their organization is able to reduce their unemployment claims and still maintain a healthy reserve balance for future claims.

“The $3.8 million we are returning to UST participants can offer their organizations the flexibility they need to execute additional mission-driven initiatives,” said Donna Groh, Executive Director of UST. “Here at UST, we are pleased to be able to continue returning funds to our members and further supporting the communities in which they serve.”

These refunds are just part of how UST serves its mission of “Providing nonprofits with workforce solutions that reduce costs and strengthen their missions.”

To learn more about the UST program for 501(c)(3) employers, visit www.ChooseUST.org. If you’re a reimbursing or tax-rated nonprofit, and looking for innovative ways to save money, fill out a free Unemployment Cost Analysis form.

Things seem to be changing though. Recently economic-focused news outlets, like Bloomberg Businessweek, have been reporting an upswing in hiring trends, lower jobless claims and that companies are re-hiring for many of the positions they previously cut.

Creating hope that the recession may be breathing its last breaths, these reports are also changing the ways employees interact at nonprofits.

Now, even though more people are volunteering with charitable and nonprofit agencies through social media and word-of-mouth, the lack of funding for employee paychecks is causing high turnovers as these employees are offered better paying jobs elsewhere.

For instance, The Chronicle of Philanthropy has found that there is an exceptionally high turnover rate for fundraisers that is costing charities lots- and lots- of money. Finding that most fundraisers are only staying at their jobs for an average of 16 months and are being recruited after only a few months, the direct and indirect costs of finding a replacement are estimated to be $127,650 per fundraiser.

Because demand for fundraisers, and many other nonprofit employees, vastly outstrips the supply of good candidates, the president of Cygnus Applied Research, Penelope Burk, says that she has found that “only 1 out of 3 fundraisers experience[s] even a day without a job.”

In conducting research for a study that is expected to be released this fall, Burk suggests that keeping fundraisers happy can save organizations thousands of dollars. She also suggests that agencies work at promoting their internal talent and offering training opportunities that can make inside people better qualified for assuming new positions.

Just one example of where high turnover is hurting nonprofits, the move to re-train the unemployed for new positions is also affecting nonprofits as many job seekers are requesting courses and training in fields like computers and nursing where they can expect a stable salary.

Operating on already tight budgets, the high rate of turnover at many nonprofits is making it even harder to survive, but by looking for ways to increase employee happiness- whether that means offering more time out of the office or the ability to work from home- more agencies can compete for the best possible candidates.

To find out if job seekers can be re-trained to work for your organization, contact your local unemployment agency or career center.

Cutting employees’ hours may seem like an easy way to reduce costs, but if you didn’t think employees could collect unemployment for that, you might be in for a (not-so-good) surprise.

It seems like a simple way to avoid having to lay good employees off, and over the past few years many employers have turned to this popular alternative. While not necessarily ideal, for many organizations reducing employees’ hours has been a more palatable option and has allowed them to keep their best workers on staff.

But what many employers don’t realize right away is that reducing hours may not yield the anticipated savings.

Why?

When an employer reduces an employee’s hours as a result of the organization’s needs, the employee could be eligible to collect partial unemployment benefits for the loss in wages. And the state will include this in the chargeback liability attributed to the organization.

If you think reducing hours is still a quick and easy way to cut costs without laying anyone off, consider this. An employee is still eligible to collect partial unemployment benefits when:

That’s why it’s incredibly important for nonprofit employers to carefully weigh the consequences of reducing hours, laying off employees, and/or using contractors before making any decisions about staffing changes. Often surprise charges can crop up when changes are made, so you will want to know what effect the unemployment claim charges may have on your organization’s benefit claims.

If you want to discuss how different staffing changes could affect your claims experience, you may want to look into membership in the Unemployment Services Trust (UST). 501(c)(3)s with 10 or more employees can find out if they qualify for membership, and receive the help of UST’s expert claims administrator to determine the impact of all staffing changes before actions are taken. It’s been proven that using an unemployment claim administrator helps save an average 15% annually on costs! Call a UST expert at 1-888-249-4788 to learn more about membership.

Tip 1: Document Everything.

Effective documentation is absolutely crucial to reducing your unemployment costs because, as the employer, you will often carry the “burden of proof” with the state.

Although good documentation can also help in matters related to the EEOC and employment litigation, documentation for discharges and voluntary quit situations is different. Namely you want to be extremely careful of the language you use in documenting a voluntary separation or discharge because the state has specific legal definitions of terms such as “unsatisfactory” work. And you will want to be careful that you are protesting claims that do not constitute good cause in a voluntary quit. These could include quits to attend school, get married, change careers, staying at home with children, or job abandonment.

Also, make sure that your organization is keeping good records. Whenever you provide policies and documentation to employees, be sure to obtain a signed acknowledgement of policies and changes to policies, and keep the receipt for at least 18 months.

Customer loyalty is a given no matter what type of business you’re running and for nonprofits who need loyal donors to survive and flourish, how you nurture your donor relationships can make or break your business.

Remember donors don’t just stop giving. They just stop giving to you. More so than your typical customer, donors want to know that their business is appreciated—let’s face it they’re not buying materials from you that can be used in their day-to-day life— they’re giving away their hard-earned cash. Never assume that they will continue investing in your cause—even if it is something they deeply believe in—if they don’t feel appreciated or at minimum acknowledged. Whether you’re talking about an online donation of $30, a married couple that donates $200 or a Fortune 500 company that gives millions, it’s your responsibility to make sure they know that their donation is making a difference in your work.

Human beings are hard-wired for connecting with others. Even when we don’t try, we can’t help but to seek relationships and form bonds. Donors want to see, feel, and experience the impact their gifts have on your organization so they believe that their continued support will keep making a difference.

Always consider the person behind the donation and not just the donation itself. Some strategies nonprofits can use to create dynamic donor acknowledgment and retention programs are:

To maintain an engaged donor base and a high retention rate year-over-year, focus your attention on donors over donations. The people giving to your organization are more important and when donors invest, it creates a bond between them and your nonprofit—keep building on that with a comprehensive relationship building program.

Infographic: A due date nears on unemployment trust fund loans

by Carla Uriona and Mary Mahling at Stateline.org

View the story at http://stateline.org/live/details/story?contentId=597982

“Later this month, states will have to make the first interest payment on the money they borrowed from the federal government to keep sending unemployment checks to workers who’ve lost their jobs. Some 28 states have outstanding loans with the federal government. According to a May estimate by Federal Funds Information for States, the total interest due by September 30 is $1.3 billion. The federal stimulus package had provided interest-free loans to states, but that grace period has expired. Earlier this year, President Obama asked Congress to waive those interest payments for another two years, but the idea went nowhere. The proposal could resurface when Congress returns this month and takes up the president’s jobs package.”

When a nonprofit charges a fee for service, or even sells product(s) as an ongoing activity directly related to its founding mission, it is considered a related business activity because it furthers the nonprofits mission. For example, if a nonprofit animal shelter charges a fee to allow a family to adopt a new puppy, it would be a related business activity.

The fee furthers the shelters mission to provide loving homes for animals in its care.

But not all business activities—or profits for that matter—are protected by a nonprofit’s tax-exempt status. So where does the line get crossed? And how can a nonprofit keep from accidentally conducting taxable business?

What is “Unrelated Business Activity”?

The simplest definition of unrelated business activity is that it is taxable profit a nonprofit earns through actions not directly related to its founding mission. But that doesn’t really mean much in the scope of things, so let’s back up and delve a little deeper.

If a business activity is not related to the organization’s tax-exempt purpose, then any profits would be considered “unrelated” and subject to the Unrelated Business Income Tax (UBIT), as applied when gross income from the unrelated business is $1,000 or more.

So, if a nonprofit animal clinic were to also run an exclusive dog breeding program—where the work is not only not performed by volunteers, but also doesn’t coincide with the founding mission of the shelter—then it’s possible that the gross income from this business venture could be considered unrelated.

In fact, it’s highly probable it would be considered unrelated.

Under IRS regulations, a nonprofit can risk losing its tax-exemption if a “substantial” portion of the organizations total activities are unrelated to its mission. When applied by the IRS, the word “substantial” is interpreted to be in effect when the unrelated business activity grows to 25% or more of the nonprofit organization’s activity.

And although the IRS does make certain standard exceptions, an activity is almost also considered to be unrelated if all three of the following are present:

– It is a trade or business

– It is regularly carried on

– It is not substantially related to furthering the exempt purpose of the organization

Although a nonprofit can engage in some unrelated business activity and pay taxes on the profit, it’s always best to be careful. If you think it may be possible that your nonprofit could be gaining 25% or more of your profits through an unrelated business venture, a lawyer well-versed in UBIT and other nonprofit tax/legal implications can help you determine how to keep your 501(c)(3) status and avoid the pitfalls of losing your tax-exempt status.

Social media marketing is an impactful—and often, cost-effective—one-to-one relationship-building tool for businesses. While it may allow you to speak to many people at once, it also allows for more of a personalized interaction with your audience or customers. For nonprofits, social media marketing can be just as beneficial as it is for a for-profit business. It’s a great way to build support for your organization, grow your number of volunteers, and increase donations. In order for your social media marketing to thrive, the commutation to your audience must be your top priority.

Engagement is the key element to a functional social platform. While it comes in many forms, communication with your audience is the leading form of engagement. This makes it crucial to respond to those who support you on social media in a timely manner, whether it’s a simple reply to comments or engaging in a particular thread—this is a feature that can be very effective when used on a consistent basis. In turn, anyone who manages the social accounts of your nonprofit must be well-versed and have a firm handle on some of the social media best practices, ensuring that your organization maintains a positive reputation.

As social media marketing evolves, new tools and platforms continue to emerge, along with new improvements to how you can better reach and interact with your audience. Best practices continue to be centered on the human experience.

Here are the top 5 social media DO’s for nonprofits:

Here are the top 5 social media DON’Ts for nonprofits:

Nonprofits who rely on state and other government funding should prepare for a bumpy road ahead in the next couple years says a new report produced by independent philanthropy consulting firm “Changing Our World, Inc.” Although the economy is seeing a shift toward the positive, state tax revenue – and therefore funding for many nonprofits – is nowhere near stable. And while the number of nonprofits has been steadily rising over the past 15 years, charitable giving has dipped significantly and would need an unprecedented rally to make up for the government funding shortfall.

Since World War II, the average recession in America had lasted 10 months. Until Now.”

Unemployment alone has created a crisis in many states. In fact, 44 “crisis states” have significantly reduced spending and are expected to cut spending even more (by $38.5 million) in social services, education and Medicaid says the report. Despite $1.5 trillion of American household wealth lost in just the first three months of the recession, philanthropy on the other hand, has been making modest gains and is expected to slowly trend upward. But the dollars are spread thinner as the number of nonprofits increases and the demand for services explodes. As the Chronicle of Philanthropy put it: “To help nonprofits cover cuts in those services, households in the hardest-hit states would have to step up their giving by 30 percent in 2011 and 60 percent in 2012—an increase the report says would be ‘historically unprecedented.’”

So what’s a nonprofit to do?

The report concludes that a multi-faceted strategy is needed for every nonprofit. Waiting on philanthropy or government funding to recover won’t work. “Philanthropy will be an important, indeed critical piece of that strategy, in part because philanthropy is often flexible and can fill in gaps not financeable through other means. However, the sheer weight of the burden will require that multiple revenue pathways be opened as well as that every managerial option for efficiency be considered.”

For nonprofits looking for a guide to this multi-pronged approach, we gleaned these tips from the report:

• Efficiency – Reach out to unemployed workers to become volunteers, possibly with a stipend. You’ll not only give them a step in the right direction but you’ll receive valuable man-hours.

• Collaboration – Reducing overhead costs is possible through a number of collaborative efforts like merging of back offices, joint purchase of property, combination of nonprofits with similar programs into a single service network, etc.

• Messaging – When asking for donations, emphasize progress instead of crisis. Talk about all the good the organization is doing in the face of the economic crisis, not how it’s struggling.

• Financial Expertise – Learn more about managing cash flow and accounts receivable so you can weather late payments and financial dips. Become your own expert on economic trends. Also think about adding people to the board with financial expertise or government experience.

• Don’t Rely on One Source – No more than 60% of any program’s budget should come from government money.

• Maintain a Reserve – This fund should be triggered only by the Board or the Finance Committee, and saved for lean times.

The American Institute of Certified Public Accountants (AICPA) has issued new standards that may impact your future audit engagement. Statements on Auditing Standards (SAS) Nos. 122–125 (referred to as “Clarified Auditing Standards” or “Clarity Standards”) introduce changes that go into effect for financial statement audits for periods ending on or after December 15, 2012.

For most entities, that means the standards will be effective for the year ending December 31, 2012, or later.

Some changes may affect all audit engagements

Certain changes may only apply in unusual circumstances

Some of the benefits of the clarified auditing standards include enhanced communication between your team and your auditors, improved audit quality and increased confidence in the audited financial statements.

These new standards will require auditors to redo much of the system evaluation work and memorandums that they carry forward from one audit to the next. As such, it’s encouraged that you work closely with your auditor to make these changes as smooth and efficient as possible!

For a more detailed version of this article, refer to Lindquist LLP’s website: http://www.lindquistcpa.com/AICPA-Audit-Clarity-Standards-11092012.htm

Barry T. Omahen , CPA, is Lindquist LLP’s managing partner based in the firm’s San Ramon office. Barry specializes in serving the audit, accounting and reporting needs of not-for-profit organizations and employee benefit plans. He serves as the partner in-charge of the firm’s quality control review and audit and accounting practice. He can be contacted at (925) 498-1546 or bomahen@lindquistcpa.com .

As a nonprofit manager, it is important to be able to give constructive feedback effectively to your employees. Being able to share and receive feedback is vital to self- improvement. Examples of how to give constructive feedback include, discussing appropriate behaviors, asking questions, creating an action plan together and building trust, just to name a few. On the other hand, there are a number of ways that your feedback could end up causing more damage than doing any good.

Listed below are five bad habits your nonprofit organization should avoid when giving constructive feedback:

1) Waiting for the annual performance review to give feedback– This method can cause confusion and make things more challenging to work through. Waiting too long to provide feedback could make people feel caught off guard or defensive, rather than being open to having a productive conversation.

2) Not providing specific examples –Concepts like “be more of a team player,” “be more professional” and “show more initiative” don’t typically sink in without the use of specific examples to illustrate them. Labels without examples can leave people feeling at a loss of how to go about making changes because they are unsure of what you’re looking for. Make sure to be specific with your feedback.

3) Lack of preparation – Making an assessment or judgment call prior to gathering all the facts and examining the logic of your assessment, can lead to a very negative outcome. Situations like these could lead to resentment or lose of respect for the manager.

4) Making an assumption of how to praise an employee– A natural tactic is to praise an employee the same way you like to be praised. However, what may work for one type of person or personality may not have the same impact on another. This is one of the many areas of managing where learning personality styles can be extremely useful.

5) Only giving corrective feedback without any positive feedback – If the only time you give feedback is to say something negative, employees will inevitably develop an automatic defensive reaction the moment you try to give them any type of feedback, whether it be positive or negative. Such conditions could be deemed hazardous for a constructive conversation and effect the overall culture of the workplace.

One of the most important concepts to understand when running a nonprofit is being able to see the bigger picture, such as key trends in corporate philanthropy. This allows your nonprofit to differentiate and grow it’s business while benefiting the community at the same time. Giving to others leads to growth and the more strategic you are, the more you, your company and your community will grow and thrive.

As a nonprofit leader, you run into many challenges, ranging from low funding to a limited number of employees that you’re able to keep on staff. Regardless of these daily hurdles, there are a number of ways to capitalize on the use of your current resources from a more creative yet strategic perspective to enhance your communication strategies.

Let’s dive into a few different approaches that your nonprofit can take to branch out on communications and other marketing efforts:

1) Utilize a variety of resources to nurture relationships with your partners. The most important resource any nonprofit has is their contacts. Ensuring that you’re using the organization’s lists of contacts (partners, media contacts, members etc.) and nurturing them through each marketing channel is key and one of the most important resources for any nonprofit. This creates more of an awareness and community around your mission and allows for continual growth with these relationships.

2) Be authentic and create original content. Since you are the biggest advocate of your organization and the mission behind it, use your knowledge and passion to create content that will allow others to connect with your brand. The use of owned media is a great way to communicate with your audience using existing channels—a monthly blog, testimonials or case studies about your members. You can also create original content to offer other shared channels—such as a guest blog article and creating this content will only require your time and will be no expense to you.

3) Gather insight from your sponsors to create relatable content. Sponsors can offer great insight when it comes to your marketing efforts and in turn can help to keep your messaging authentic—allowing you to connect with the audience you want to engage. Creating a consistent message across all marketing materials is important for your brand, your mission and to help you stand out amongst all the noise.

Nonprofits offer a sense of community for their many volunteers, donors, and members. These are the individuals that are the passion behind an organization and want to see your nonprofit succeed. The use of your resources will help you ensure that your current marketing efforts and communications are providing optimal return and are reaching the audiences you want to connect with.

First introduced in the early 1990’s the term “employment branding” refers to the whole of an organization’s efforts to communicate what makes it a desirable place to work. Typified by national companies like NPR, Google, Zappos, REI and local companies unique to every community, the importance of employment branding is staging a revolution.

Driven in large part by the mainstreaming of social media recruitment channels and word of mouth job hunting, employer branding lends itself easily to nonprofits.

Don’t believe me? Well, because values are often the underlying structure for an organization’s reputation (aka branding), many nonprofits can easily incorporate their pre-established mission into their employment brand. By doing what you love, and what you believe in, you (and your employees) have probably already worked toward creating a strong employment brand.

Research backs the importance of successful employment branding. Over and over again workers report that starting salary is less important than their perception of the organization and the satisfaction that they receive from the employer’s culture.

So what can you do to build a powerful employer brand?

SUMMARY: The proposed FUTA taxable wage base increase would have a heavy impact on employer rates, reports the Unemployment Services Trust.

Santa Barbara, CA (PRWEB) November 10, 2011 — With most state unemployment funds now defunct after being depleted faster than they could be replenished during the recent recession, many states have found themselves with deficits that are growing as time passes. The United States unemployment tax system is in need of some serious restructuring, and it appears that the road out of the red is not a pretty one. Now, it’s ‘all eyes ahead’ through the thick of high unemployment, increased tax rates and special assessments. But, looking ahead to 2014, the proposed increase in the FUTA (Federal Unemployment Tax Act) taxable wage base from the current $7,000 to more than double at $15,000, could be devastating to employers if the proposal goes through, reports the Unemployment Services Trust (UST).

The proposal also includes a cut to the net FUTA tax rate from 0.80% to 0.38%, reducing the percentage by more than half. With the FUTA tax currently set at $56 per employee per year (0.008 x $7,000 = $56), and the proposed tax to be set at $57 per employee per year (0.0038 x $15,000 = $57), at first glance the change may seem trivial. The federal level, though, is not where employers would feel the pinch.

The pinch is found in the fact that states will have to match or exceed the FUTA $15,000 wage base, or face substantially higher FUTA rates. Thirty-two states (as well as Washington D.C . and Puerto Rico) would need to increase their unemployment taxable wage bases. There are currently 20 states with taxable wage bases of $10,000 or lower. The last time that the UI wage base increased was in 1983, so the increase is long overdue. However, it is expected that employers in these states will likely pay fifty percent more state UI taxes beginning in 2014 if the proposal is enacted.

Employers in states like California, who currently have a taxable wage base of $7,000, and for example, have an unemployment tax rate of 4.0%, will see their cost per employee increase from $280 to $600 annually. An increase this large (114%) would be detrimental to many employers, but especially nonprofit organizations, which typically have a tough time raising funds to cover operational expenses to begin with.

For 501(c)(3) organizations, federal law allows organizations to opt out of the state unemployment tax system and instead reimburse the state only for their own workers’ unemployment claims, dollar-for-dollar. When paying into the unemployment tax system, companies across the U.S. pay an average $2.00 for every $1.00 paid out in benefits, and these dollar amounts will likely grow where taxable wage bases will be increasing.

It should be noted, however, that nonprofits may find opting out of the state unemployment tax system to be burdensome on their HR department since they must monitor unemployment claims more closely, both to make sure they are not paying for unwarranted claims and also to ensure they have the funds on hand whenever a claim is filed. Some nonprofits have chosen to join an unemployment trust to help monitor claims, set aside funds in an account, and get support for their human resources department. For more information about joining an unemployment trust, visit http://www.ChooseUST.org.

Because nonprofits tend to have limited resources accompanied by greater demands, employees often face higher stress levels and workloads. Such unrelenting demands can weaken internal morale. And, with a deteriorating organizational foundation, mission advancement becomes much harder to achieve.

Developing a consistent and efficient morale “check-in” system can be an effective tool in maintaining a pleasant work atmosphere and satisfied employees. One of the best ways to fully realize this internal bliss is to cater towards employee wants and needs; often accomplished through relationship development and positive reinforcement.

Here are a few tips on how to better identify and improve morale:

The only way to advance your nonprofit’s mission is through employee support and their dedicated work efforts. Taking time to focus on morale improvement can make a huge difference in your organization’s success.

Read more tips on how to improve internal morale here.

Though prioritizing leadership development is a step in the right direction, nonprofits must simultaneously analyze and define both strategy and leadership development procedures in order to transform goals into achieved reality.

Nonprofits often lose momentum and general direction after failing to go over the specifics. More often than not, leadership development procedures fall into generalized categories. Because no one strategy or goal is alike, it’s important to identify the specific skills required for every set objective.

When looking at future development plans, your organization must develop a consensus around what skills your employees, leaders, and future leaders currently possess, and what behaviors will be required for future endeavors. Identifying the gap between present and future skill sets will better allow you to create a plan of action to achieve such skills.

Bridgespan created a process to help organizations both analyze potential changes in business strategy, and create a leadership development plan to address these organizational shifts.

When looking to the future, ask yourself these questions:

Overall, you must think of strategy and leadership development as a package deal. Greatly affecting one another, strategy and leadership development must consistently be analyzed side by side.

By closely monitoring your organization and its future leadership training process, you can decide what’s effective and what still requires improvement. Attention to detail is the key ingredient to identifying potential weaknesses, harnessing current strengths, and bridging the organizational gaps.

Learn more about linking leadership development and strategy here.

Unemployment Overpayments: Fraud or flawed system?

By Pamela M. Prah, Stateline.org

View article at www.Stateline.org

When the Obama administration revealed that more than $17 billion in jobless benefits had been paid out improperly, a stream of headlines suggested that cheats were bilking the unemployment insurance system.

The reality is a lot more complicated, as the U.S. Department of Labor itself noted when it reported state-by-state numbers last month. While fraud was responsible for a small part of the overall “improper payments” figure, much of the total came from less devilish glitches, such as failing to provide proof that a payment went to the right person. The total also included cases where beneficiaries were underpaid, in addition to the cases where the government paid them too much.

Louisiana is one state that has found itself on the defensive. Federal figures showed that 44 percent of its unemployment insurance payments were “improper.”

“The numbers being reported … for Louisiana are not all overpayments,” Curt Eysink, executive director of the Louisiana Workforce Commission, said in a statement. “Nor should those amounts be collectively viewed as ‘waste, fraud and abuse.’” Eysink notes that what the federal government called “overpayments” largely went to unemployed workers who were eligible to receive unemployment benefits; the problem was that the state couldn’t prove that these people had formally registered with the state to say they have searched for jobs.

Crunch time for unemployment insurance

The issue is a sensitive one for state unemployment offices, which have been crushed by heavy workloads as joblessness remains stuck above 9 percent nationally. In the first year of the recession, states saw a 120 percent increase in claims from unemployed workers.

The program, run jointly by the federal government and the states, provides monthly benefits to workers who become unemployed through no fault of their own. Most states have had to borrow money from the federal government to keep checks going to the jobless; last month, states had to start paying interest on those loans.

The stepped-up scrutiny of jobless benefits is part of the Obama administration’s government-wide effort to reduce the $125 billion in “improper payments” the government made in 2010. Unemployment insurance was named one of the “high-error” programs. That was partly because the error rate of 11 percent was more than double the 5 percent rate that the administration set as a doable goal. The enormous size of the program, which paid out $156 billion in benefits last year, also was a factor.

Nationwide, Indiana and Louisiana had the highest error rates, with improper payments accounting for more than 43 percent of the total amount paid in both states. Others that landed high on the list include Arizona (20 percent), Colorado (17 percent) and Virginia (18 percent). There’s no financial penalty for states with high error rates, but until they get their error rates down below 10 percent, they’re subject to greater federal scrutiny and reporting requirements.

States say the federal campaign has left the perception that fraud is primarily to blame for their error rates. In fact, the federal government’s own estimate says that 2.4 percent of unemployment insurance benefits were overpaid due to fraud in 2010.

By and large, factors other than fraud are driving error rates. For example, many of the states under federal scrutiny are experiencing “work search” errors that they say are a result of dramatic changes in how people today file for unemployment benefits and look for jobs. Gone are the days when people had to step into a state unemployment office to fill out the paperwork and sit down with a case worker to talk about which employers they applied to for jobs. Nowadays, unemployment insurance applications and job searches are done online and employers don’t always save the hundreds of résumés they receive electronically.

Kevan Kaighn, of Arizona’s Department of Economic Security, suggests the reporting mechanisms may not have kept up with the times. “Arizona has historically asked employers to confirm that a claimant did apply,” Kaighn says. “If the employer was not able to provide verification … the Department would count the claim as an error.”

Complaints of unfairness

Some states also say they are being faulted for having stricter standards than the feds. Nearly 80 percent of Indiana’s improper payment problem was due to difficulties tracking things that the state requires but the federal government doesn’t. For instance, the unemployed in Indiana must show they have looked for work with three employers. If a recipient lists only one job or lists incomplete information for the other two, those are counted as errors, explains Valerie Kroeger of the state’s Department of Workforce Development.

The U.S. Department of Labor says it has been working with states since last year on these kinds of issues. The department says it’s only fair to assess states based on their own rules, but agrees that the wide variation in state unemployment systems may make it misleading to compare different states on their payment accuracy rates. “States with stringent or complex provisions tend to have higher improper payment rates than those with simpler, more straightforward provisions,” the department says on its website.

The private sector also has a role in improving the accuracy of payment information. One of five overpayments nationwide occurs because the worker’s last employer didn’t provide the state accurate or timely information about layoffs or hiring. The result can be people receiving benefits that they may not be entitled to. “We are trying to get the message out to employers how important this is,” says Joyce Fogg of Virginia’s Employment Commission.

Nationally, the leading cause of overpayments is when once-unemployed workers find jobs and continue to claim jobless benefits. On this front, the Labor Department encourages states to check the information from unemployment claims against a large national database of all new hires. Washington State, which has been doing this for years but nevertheless posted an error rate of 14 percent, estimates that these matches uncovered half of all its fraud-related claims. According to the National Employment Law Project, an advocacy group, states typically recover about half of the money lost to improper payments.

James Sherk of the Heritage Foundation says states have a point that the headline numbers would lead people to believe that more fraud occurs than actually does, but says states still need to fix the problems. “The state should not be continuing to send checks to workers after they have returned to work, and it should be verifying the work-search requirements are met,” Sherk says. “Those and other requirements exist for a reason and need to be enforced.”

Outdated technology blamed

What many states say they need most is money to replace outdated computers, which they say account for many of the problems. Arizona and Colorado are part of four-state consortium that was recently awarded $72 million in federal funds to replace archaic systems. “This represents a desperately needed modernization,” says Kaighn of Arizona, who says the state is currently using 1980s mainframe technology.

Washington State estimates it will cost more than $100 million to replace its two main computers involved in processing unemployment claims. The state is spending $54 million to replace the main tax computer and has set side another $30 million for the benefits side. According to Sheryl Hutchison, a spokeswoman for the state’s Employment Security Department, it will probably take up to eight years for those projects to finish.

The US Department of Labor has released instructions to states in response to the federal sequester that became effective March 1, 2013.

Changes to UI, as announced in the recent UI program letter, could affect your organization. Have you read the full letter yet?

Regular state unemployment compensation amounts are not directly impacted by the sequester. However, the details of the impact on funding for UI administration at the federal and state level and in sorting out the reduction amounts for individual weekly Emergency Unemployment Compensation (EUC) and Extended Benefit (EB) claims will be confusing for claimants, state agencies and employers and will likely result in higher error rates due to the short time to respond with programming, lack of training for staff, and misunderstanding of changes.

Sequestration specifically applies to

The DOL has asked that states make adjustments necessary to implement the reductions as soon as possible, and that EUC weekly benefit amounts and total EUC benefits payable be reduced by 10.7% effective with the week of March 31, 2013. However, recognizing that there may be some states that are not able to implement the reductions on March 31, 2013, states may delay implementation but the applicable percentage reduction will increase with later implementation.

The DOL has prescribed a notice to be sent to claimants explaining the reason for the reduction in EUC payments.

Impact on charges to state UI trust fund and employers in federal share of Extended Benefits

Of particular concern to employers in states that have triggered regular Extended Benefits (EB) is that the federal share of the EB payment will be reduced from the temporary 100% federal reimbursement, increasing the share to be paid through charges to employers and the state unemployment trust fund. Alaska is currently the only state triggered, but this cut in reimbursement should be noted as a concern in other states as well. A state may pass legislation detailed in the DOL program letter to reduce the EB Weekly Benefit Amount by the percentage of the cut.

A number of states enacted optional EB trigger provisions due to or conditioned on there being 100% federal reimbursement for the payments. The federally promised 100% reimbursement is now being cut, raising the policy and legislative issue as to the impact on laws requiring 100% reimbursement and states that assumed 100% federal reimbursement when enacting the optional triggers.

State administrative complexity will cause overpayments

Instead of simply reducing the total amount payable in EUC, the Office of Management and Budget and DOL have decided to implement the reductions with respect to individual weekly claims as well as in reduction of the total. The result of this decision will be difficult programming and administration by states with very little additional administrative funding ($40,000 per state). The determination of the amount of the reduction on a weekly basis, the relationship to state weekly benefit amounts, overpayments and a host of other issues are likely to result in significant numbers of overpayments and confusion on the part of claimants.

Employers and states should review the program letter (linked below), specifically with reference to EB considering measures to avoid increased charges to state unemployment trust funds resulting from a reduced federal share reimbursement.

The full program letter may be viewed at http://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=4985.

From the Wall Street Journal

by Sara Murray

Nearly $19 billion in state unemployment benefits were paid in error during the three years that ended in June, new Labor Department data show.

The amount represents more than 10% of the $180 billion in jobless benefits paid nationwide during the period. (See a map of improper payments by state.) The tally covers state programs, which offer benefits for up to 26 weeks, from July 2008 to June 2011. Layers of federal programs that help provide benefits for up to 99 weeks weren’t included.

Sortable Chart of Each State’s Overpayments

The figures were released Wednesday as the Obama administration promotes its bid to reduce waste at federal agencies. The federal government foots the bill for administering the programs, and states are supposed to pay for the benefits. Many states exhausted their unemployment insurance trust funds during the long recession and slow recovery, prompting them to borrow from the federal government to replenish their funds.

Improper payments most often occur when recipients claim benefits even though they have returned to work; employers or their administrators don’t submit timely or accurate information about worker separations; or recipients don’t correctly register with a state’s employment-service organization.

The Labor Department launched a plan to crack down on the improper payments, targeting Virginia, Indiana, Colorado, Washington, Louisiana and Arizona in particular for their high error rates. Those states will undergo additional monitoring and technical assistance until their error rates dip below 10% and remain there for at least six months, according to the Labor Department.

“The Unemployment Insurance system is a unique partnership between the federal government and the states. States bear the responsibility of operating an efficient and effective benefits program, but as partners the federal government must be able to hold them accountable for doing so,” Labor Secretary Hilda Solis said in a release.

Indiana had the highest error rate, with improper payments accounting for more than 43% of the total amount paid. But Mark Everson, commissioner of the Indiana Department of Workforce Development, said the differences in error rates stem from variations in state programs.

“To characterize it as waste, fraud and abuse is just manipulative,” Mr. Everson said. “There’s no way in the world you could cut the 43% of people off.”

Mr. Everson pointed out that in Indiana, benefit recipients are required to list three work searches. If a recipient fills out only two of the three searches correctly, there are cases when the recipient can still receive benefits. But that counts as an error.

The Labor Department noted, “it may be misleading to compare one state’s payment accuracy rates with another state’s rates States with stringent or complex provisions tend to have higher improper payment rates than those with simpler, more straightforward provisions.”

UST releases 2018 UI toolkit to help nonprofit organizations better understand unemployment insurance options and claims management best practices.

UST, a program dedicated to providing nonprofits with workforce solutions that reduce costs and strengthen their missions, announces the release of their 2018 UI Toolkit– comprised of UST’s top unemployment guides for managing unemployment. These tools provide valuable information that can help nonprofit organizations better understand the ins and outs of unemployment from the employer’s perspective.

The 2018 UI Toolkit provides exclusive access to unemployment claims management tips, how-to-guides and an informative webinar recording. Plus, it showcases the top 5 things nonprofits must know about unemployment insurance, as well as best practices for protesting claims.

For a limited time, the toolkit is available for a free download, and here are some of the highlights:

“Here at UST, we want to provide nonprofits with the top resources to better manage their unemployment needs,” explains Donna Groh, Executive Director of UST. “This UI Toolkit provides the insight nonprofit organizations need to know when it comes to managing claims and avoiding costly liability.”

Be sure to download your free UI Toolkit today!

Want access to more nonprofit toolkits, checklists and tips? Sign up for UST’s Monthly eNews.

Most nonprofit leaders recognize that employee retention can be a challenge and with limited resources, can lead to a lack of employee recognition. Nonprofit employees tend to have a passion for their organization’s mission—a sense of pride in their work and view their current employment as a career, not just as a job. So how do nonprofit organizations go about best supporting their employee’s goals and achievements?

Celebrating an employee’s career achievements by offering service awards is an effective strategy on multiple levels. Here are a few ways your organization can continue acknowledging your employees on a consistent basis:

1. Acknowledging reliability: While it can seem like a huge undertaking to implement a career achievement program, organizations that offer such programs are able to keep employees an average of two years longer than organizations that don’t. If the program proves to be effective, employees plan to stay at their current employer for an additional two years on top of that.

2. Reward accomplished career goals: According TLNT’s research, “81% of employees feel career celebrations help them feel appreciated for their work and found that 19% more employees strongly felt their current company cared about employees. Also, 18% more employees strongly felt they fit in and belonged at their current company if the company offered service awards.”

3. Encourage employee & culture connection: Recognizing an employee’s career milestone can offer an opportunity to connect back to the foundation of the organization. This can help employees feel that they are making an impact and doing their part to benefit the organization as a whole.

The benefits of a career achievement program will not only bring focus to your employees and their accomplishments, it will increase the overall morale of the organization and make your nonprofit a desired place to work at for future employees.

A recent Bridgespan Group survey has revealed that most nonprofits rank their ability to provide development and growth opportunities to employees as their fourth greatest management weakness overall even.*

The same survey went on to explain that a lack of employee development has become the “Achilles heel” of the nonprofit community. Because only 30 percent of nonprofits have created or sustained an agency-wide plan for employee development—and only 23 percent of those track its progress—the large majority of organizations don’t have a clear understanding of what skills they need for each position as their mission evolves. Many more don’t even have an idea of where that talent would come from.

To help you develop a plan to address future leadership gaps, Bridgespan put together a list of 52 free ways that nonprofit agencies can improve their internal employee development. Some of the easiet and most impactful employee development initiatives that they list include:

On its own, on-the-job development isn’t enough though. To foster truly effective options for employee and organization development, get your board involved with individual employees through the agency. And have each person who is involved with your development program—whether that is a board member or a developing leader—regularly assess what works best at getting employees ready so that you are more likely and more able to advance them within your agency.

*Rounding out the top 3 are communication of priorities, coordination across organization boundaries, and performance assessment and consequences.

In California, where a 10.8 percent unemployment rate is reported with general good feelings, unemployment insurance presents more than one challenge to nonprofits as the state’s UI fund continues to fall deeper into insolvency. With plans to borrow more than $312.6 million from the state Disability Insurance Fund, how will nonprofits remaining in the state UI system counter the hefty bill coming at them?

While there is no good answer, nonprofits which have 10 or more employees are urged to consider leaving the state system to become reimbursing employers who only pay for the costs of the claims submitted by their former employees.

Because the financial recovery continues to trudge along for nonprofits, many of which cannot expect to return to pre-Recession levels of funding for 10 or more years, according to a recent study, it is important that nonprofit leadership continue to successfully assess the options available to them.

Nonprofits: What We’ve Learned

When the state UI fund ran out of money in 2009, during the height of the financial crisis, California had an unemployment rate of 11.3 percent—the fourth highest in the country—and about 1.75 million unemployed workers. Today, the rate remains still high at 10.8 percent.

But many nonprofits made it through the Recession relatively unharmed and in fact were able to raise their hiring 5 percent over a three year span as more help was needed by beneficiaries.

Although a high number of small agencies were forced to close, and many medium-sized agencies had to merge with larger organizations, nonprofits are used to tightening up their belt loops and surviving tough financial times to continue providing benefits to their community.

How can this knowledge be used to help California and other states facing high UI costs?

With the largest unemployment insurance deficit in the nation, cash-strapped California has already borrowed from the state Disability Fund once before, but little is being done to systematically change the way that the state releases funds for UI. (Both loans must be repaid within four years of their initial borrowing date, but no way to repay them has been presented.)

Counter-intuitive though it may be, by removing your nonprofit from the state UI tax system and instead paying only for your own UI claims you allow your agency to do more with the money you have and for the mission you’ve committed to. This action, in a small way, also calls for UI reforms across the nation as more nonprofits leave the state system for the cost savings found in self-reimbursing.

To learn more about how you can leave the state system and become a reimbursing employer, visit www.ChooseUST.org/501c3-unemployment-alternatives/ or sign up for an upcoming webinar.

Summary: Partnership creates potential savings for many nonprofits in the state of Maryland, reports the Unemployment Services Trust.

The Unemployment Services Trust (UST) and Maryland Nonprofits are proud to announce that they are joining forces to work with nonprofit organizations in Maryland to help save money on unemployment expenses.

Maryland Nonprofits is the primary source for guidance and assistance on nonprofit management issues for Maryland’s near 1,600-member nonprofit community. Maryland has 255,408 nonprofit employees within all service areas, including: Arts, Culture & Humanities, Education, Environment & Animals, Health, Human Services, and Public & Societal Benefit. Each year, more than 300,000 nonprofit professionals utilize Maryland Nonprofits’ resources, and now Maryland Nonprofits will be better able to assist its members with the help of UST’s cost-saving program.

Donna Groh, Executive Director of UST stated: “We are so pleased to enter into this partnership with Maryland Nonprofits. UST exists to save money for nonprofits so they can use those funds to advance their missions. Now, more than ever, nonprofit organizations need to maximize their resources and UST will work with Maryland Nonprofits’ members to do just that.”

UST, a national unemployment trust, helps organizations opt-out of their state’s unemployment tax system. Permitted by federal regulation, opting-out allows nonprofits to handle their own unemployment claims, and save money. UST members own their own account, which is a pre-paid asset used to cover unemployment expenses that occur when an unemployment claim is filed by a former employee. The nonprofit becomes a “direct reimbursing employer,” meaning they only pay for unemployment collected by former employees, and are sheltered from rising tax rates. UST offers asset-protection and unemployment claims monitoring that many nonprofits need to safeguard their cash flow from volatile or unwarranted unemployment claims. In addition, UST members benefit from conservative asset investment, stop-loss protection, bonding, and professional human resources support.

UST, founded by nonprofits for nonprofits, is the largest of all national unemployment trusts. Consisting of more than 2,100 member organizations from 47 states (and DC), UST has been helping nonprofits reduce expenses since 1983. UST’s long-standing relationship with nonprofit organizations has provided more than $33 million in refunds to trust members; and an additional $35 million in annual unemployment claim savings, presenting organizations with valuable resources to put toward achieving their missions.

For more information about UST, visit http://www.ChooseUST.org or call (888) 249-4788. You can also visit Maryland Nonprofits on the web at http://www.MarylandNonprofits.org.

Knowing exactly what separation details will be needed in response to the state and having the increased lead time needed to gather that information enables nonprofits to win more claims at the initial level of protest. This is especially important to nonprofit employers where winning claims up-front helps lower claim costs by eliminating benefit payments to former employees while waiting for an unemployment hearing to be scheduled.

Electronic receipt of claims notifications through SIDES also helps reduce follow up time, as a complete response is provided as part of each “first response.”

Ultimately, the program reduces improper payments, since the states are provided with all of the details needed to make the correct ruling in the initial determination. As a result, participation in SIDES saves both time and money.

For nonprofit employers, reducing the high costs associated with unproductive former employees helps increase the funds available to help others and attain organizational goals.

Some of the biggest benefits to nonprofits include:

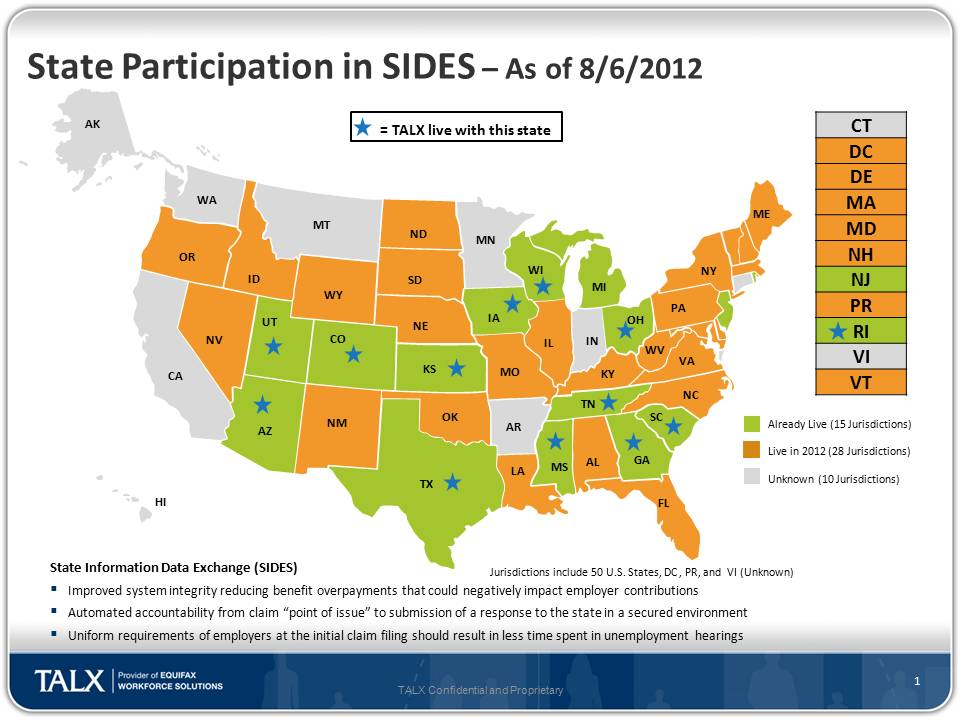

UST’s claims monitor, TALX, has been involved with SIDES from its inception and is one of only two forward-looking unemployment cost control organizations utilizing the program to help 501(c)(3) members reap the benefits of this improved claims process.The program has been successful, thus far, and TALX is now live with SIDES in 10 states (AZ, CO, GA, IA, OH, RI, SC, TX, UT, WI). An additional 10 states are expected to go live by the end of August, with 21 more going live by the end of the year. There are 9 states that have not yet made a commitment to participating in SIDES.

If you are a UST member, please contact your TALX representative to learn more about SIDES.

By categorizing an organized nonprofit sector to include the number of nonprofits per capita in each community and the degree to which nonprofits directly engage local residents, the study, “Civic Health and Unemployment II: The Case Builds,” presented three key findings:

Further emphasizing the importance of an organized nonprofit community that is involved with those in the local area, the study suggests that while nonprofits directly contribute to a lower unemployment rate by creating jobs, there also appears to be a ripple effect in which organizations that engage with local residents create a change in the local unemployment rate.

Released by the National Conference on Citizenship this study may well become highly influential for those who most often are called upon to discuss the importance of establishing strong nonprofit sectors. And although it doesn’t offer all the answers as to why organized, involved nonprofits are able to directly impact unemployment rates, there will undoubtedly be more information to come in the next few months as the unemployment rate continues to trend downward.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

In this day and age, the reference check has become much more than a mere formality. Shedding light on what a candidate is really like, calling references and verifying former positions and educational history helps enlighten the hiring team as to what the best, and sometimes worst, parts of working with a particular candidate are.

Underestimating the amount of information you can glean from conducting reference checks is done all too often though. Because it takes significant time and energy to call every reference, it might be easier for some agencies to look at having a third party professional recruiter talk to the references.

If this isn’t a strong option, the key to conducting the most successful reference checks lies in asking, and listening, to carefully developed questions that speak to what you most want, and need, to learn about a candidate. Making the process feel like a conversation- one where you’re up front and open about what the opportunity is and what information you’re looking to learn about the candidate- can lead to valuable revelations that help cement your decision and show you where you can best support and develop a new hire.

When developing your reference check questions, you should look for both hard data, such as questions about the candidates skill set, and qualitative data which will help you better understand the candidate’s communication and management style as well as their strengths and areas for improvement.

Some sample questions might include:

Speaking with a broad list of references- personal, professional, and developmental- will help you put together the best possible picture of what a candidate would look like in your organization. Since few candidates will put down anyone that would give a less-than-stellar review of them and their abilities, drill down deep into how the reference talks about the candidate and their level of enthusiasm about your candidate for the most telling information.

Thankfully, after all of the reference checks are done, if the candidate still matches your expectations, you can finally make your offer.

Read more about checking candidates’ references.