As nonprofit organizations prepare to return to business as usual, there are quite a few new safety protocols being put in place to ensure that employees return to a safe work environment. The Center for Disease Control – CDC continues to release updated guidelines for employers to help prevent and slow the spread of COVID-19 in the workplace. When making decisions around business operations, two main components should be factored in: (1) the level of disease transmission in your community and (2) how prepared your business is to protect both your employees and customers.

Employers are encouraged to coordinate with their state and local health officials to acquire timely and accurate information to provide updates to employees as needed. If your nonprofit’s business operations were put on hold, or are gearing up for workforce re-entry, this is an opportunity to update your COVID-19 preparedness, response and control plans.

When making the appropriate updates to your organization’s COVID-19 plans, the following items should be included:

Be sure to take the time to communicate with your employees of any changes and ask for their input—their questions and concerns can ensure all your bases are covered when creating the COVID-19 plan for your organization. Educating our employees on the severity of taking the necessary precautions to keep themselves and others safe is vital. To protect themselves while at work and at home, new policies and procedures related to illness, cleaning and disinfecting should be followed.

To ensure a safe workplace environment, employers should advise their employees of the following:

While there is much more to learn about the severity and characteristics of this virus, as a nonprofit employer, you can do your part to follow important guidelines to create a safe and healthy working environment for your dedicated employees.

Are you still trying to figure out how to navigate the uncertainty of COVID-19 and its impact on your nonprofit and its employees? When you download UST’s new employer guide, 3 Critical Steps to Maintain a Resilient Nonprofit During COVID-19, you’ll discover helpful tips on maintaining your nonprofits operations during the current pandemic and beyond.

This short employer guide shares valuable insights and key strategies for securing your brand during times of crisis, including:

This guide will not only enable you to stay on top of strategy development, but also equip you with the tools you need to help your employees feel safe. Download your FREE copy today!

Nonprofit employers have faced unimaginable challenges in the wake of the COVID-19 pandemic. Now, as states start permitting businesses to reopen, nonprofits across the country are trying to figure out what that looks like for them, their employees and the communities they serve.

This informative webinar recording provides helpful tips for preparing to welcome employees back to the office while maintaining compliance with state and federal regulations related to the Coronavirus. Watch now to discover:

For additional COVID-19 employer resources and FAQs, please visit our COVID-19 Resource Center today!

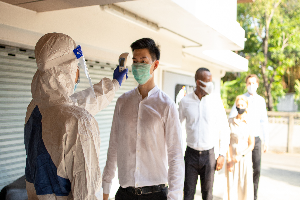

Question: Can we screen employees returning to work for COVID-19?

Answer: Yes. Generally, inquiries about an employee’s health or a medical exam (like a temperature check) would not be allowed, but the Equal Employment Opportunity Commission (EEOC) has stated that screening employees for symptoms of COVID-19 is allowed since it is a direct threat to others in the workplace. Because of that, you may inquire about symptoms related to the virus, require self-reporting by employees, and take employees’ temperatures.

Known symptoms of COVID-19 include fever, cough, chills, shortness of breath or difficulty breathing, muscle pain, headache, sore throat, and sudden loss of taste or smell. As the medical community learns more about COVID-19, additional symptoms could be added to this list. Employers can check this page for currently recognized symptoms.

If you decide to do screenings, make sure you screen all employees; otherwise you may find yourself in the middle of a discrimination claim. And remember that all information about employees’ health — including a lack of symptoms or temperature — must be kept confidential.

Q&A provided by ThinkHR, powering the UST HR Workplace for nonprofit HR teams. Have HR questions? Sign your nonprofit up for a free 60-day trial today.

While we continue to adjust to this new “normal” of working remotely—with little to no face-to-face interaction—the COVID-19 pandemic has taken a major toll on nonprofit employees and their mental health.

This informative webinar provides helpful tips on how nonprofit leaders can help keep employees productive and engaged in day-to-day work activities. Watch now to learn key strategies that include:

For more access to nonprofit specific how-to guides, checklists and resources? Sign up for UST’s monthly eNews today!

Question: What’s the difference between a furlough and a layoff?

Answer: First, you should note that the language used when sending employees home for a period of time is less important than communicating your actual intent. Since temporary layoffs and furloughs are only used regularly in certain industries (usually seasonal), you should not assume that employees will know what they mean. Be sure to communicate your plans for the future, even if they feel quite uncertain or are only short-term.

Furlough

A furlough continues employment but reduces scheduled hours or requires a period of unpaid leave. The thought process is that having all employees incur a bit of hardship is better than some losing their jobs completely. For example, a company may reduce hours to 20 per week for a period of time as a cost-saving measure, or they may place everyone on a two-week unpaid leave. This is typically not considered termination; however, you may still need to provide certain notices to employees about the change in the relationship, and they would likely still be eligible for unemployment.

If the entire company won’t be furloughed, but only certain employees, it is important to be able to show that staff selection is not being done for a discriminatory reason. You’ll want to document the nondiscriminatory business reasons that support the decision to furlough certain employees and not others, such as those that perform essential services.

Layoff

A layoff involves terminating employment during a period when no work is available. This may be temporary or permanent. If you close down completely, but you intend to reopen in the relatively near future or have an expected reopening date — at which time you will rehire an employee, or all employees — this would be considered a temporary layoff. Temporary layoffs are appropriate for relatively short-term slowdowns or closures. A layoff is generally considered permanent if there are no plans to rehire the employee or employees because the slowdown or closure is expected to be lengthy or permanent.

Pay for exempt employees (those not entitled to overtime)

Exempt employees do not have to be paid if they do no work at all for an entire workweek. However, if work is not available for a partial week for an exempt employee, they must be paid their full salary for that week, regardless of the fact that they have done less work. If the point is to save money (and it usually is), it’s best to ensure that the layoff covers the company’s established seven-day workweek for exempt employees. Make it very clear to exempt employees that they should do absolutely no work during any week you’re shut down. If exempt employees do any work during that time, they will need to be paid their normal weekly salary.

Pay for nonexempt employees (those entitled to overtime)

Nonexempt employees only need to be paid for actual hours worked, so single day or partial-week furloughs can be applied to them without worrying about pay implications. We recommend that you engage in open communication with the affected employees before and during the furlough or temporary layoff period.

Q&A provided by ThinkHR, powering the UST HR Workplace for nonprofit HR teams. Have HR questions? Sign your nonprofit up for a free 30-day trial today.

Nonprofits are facing unprecedented challenges navigating COVID-19 and its impact on day-to-day operations. Our recent webinar was designed to provide some valuable insight into the latest unemployment legislation and its impact on your organization and its employees.

This informative webinar recording discusses how COVID-19 is impacting nonprofits nationwide, what alternatives there are to layoffs and/or workforce reductions and more. Watch now to discover:

For additional COVID-19 employer resources and FAQs, please visit our COVID-19 Resource Center today!

It’s natural to feel stressed or anxious when presented with unprecedented circumstances. The coronavirus or COVID-19 continues to present new and unique challenges that evolve every day. Nonprofit employers are navigating unchartered waters and their employees are along for the ride. Many are working from home for the first time, isolated from co-workers, friends and family while also home-schooling their children and or taking care of elderly family members. This disruption in our daily routines has caused added anxiety, stress and strain—physically, mentally and financially. All of this combined makes it more important than ever to find new ways to interact and communicate with others while also taking care of our mental health and physical well-being.

You can’t avoid stress completely but too much stress over long periods of time can be harmful to your health—ranging from headaches, decreased energy, irritability, body aches and pains, irregular sleep or insomnia, difficulty concentrating or worse, can contribute to serious health problems such as high blood pressure, heart disease and mental health disorders. The good news is you can get ahead of stress by recognizing how you feel and practicing ways to find calmness.

Below are some ways to manage stress and anxiety through positive self-care and healthy social connections:

Be selective about how you consume COVID-19 information – while it’s good to be informed and aware of what’s going on around the world and in your community while we combat this virus, ensure you follow credible sources such as the Centers for Disease Control (CDC) and the World Health Organization (WHO) and limit how much time you spend absorbing that information.

Set boundaries on your work schedule – it’s easy to keep working when you have no reason to get up and leave the office but it’s important that you set a schedule with healthy boundaries and stick to it.

Maintain a routine – having some semblance of structure and consistency from your pre-Coronavirus life will help to keep a sense of control and normalcy while also making it a little easier to readjust to the outside world when it’s time to go back to work.

Limit your time online – set a timer, focus on positive things while you are online and divide your time between the different sites you like to browse. You can even install a website blocker to help temporarily force you off certain websites.

Stay connected – our greatest resource for alleviating stress is still connecting with our loved ones. Don’t just pick up the phone, use Skype, FaceTime or Google Hangouts to get some face to face time.

Leverage Mindfulness-Based Stress Reduction – the practice of meditation can help relieve anxiety, boost your mood, improve sleep and promote mental and emotional health—the benefits are endless and you can do it anytime, anywhere.

Stay active – this isn’t just good for your physical health but also for your mental health so don’t let this time at home go to waste. It’s important to keep moving, whether it’s strenuous exercise, Yoga or even just light stretching. You can find an entire universe of free classes online right now with many instructors live-streaming classes from home.

Get outdoors – fresh air goes a long way in easing the feelings brought on by stress and anxiety. Take a long walk around your neighborhood or go for a bike ride and enjoy some new scenery—all while maintaining physical distance from others of course.

Embrace a hobby – partake in something you really enjoy doing just for the fun of doing it. Something that requires attention and physical movement like embroidery, scrap-booking, painting or sewing to name a few.

Learn a new skill – knowledge is power as the saying goes. There are an unlimited number of online classes you can partake at no or minimal cost that range from bread making and drawing to crochet and learning a new language. Skillshare and Udemy are great resources.

Take an adventure through a book – start a mini book club and invite your friends to participate via video so everyone can share their thoughts and interact as a group.

Get in the kitchen – if you enjoy cooking or baking, there’s no better time than now to try out some of those recipes you’ve been waiting to experiment with.

Do some Spring cleaning – it is Spring after all. Organize those drawers that have been begging for order, clean out your closets, and donate what you no longer need or use, or work on getting your filing cabinet in order.

Watch feel-good movies – musicals are a great way to lift your spirits if you’re into that or distract your mind with an old black and white classic.

Count your blessings – take a few moments to focus on all that you have. Be thoughtful and sincere about who and what you appreciate in your life and let them know.

Find an online support group – there are a plethora of websites out there that offer virtual or phone options for group or individual support as well as live chat rooms. Having others to talk to that share your same concerns can help alleviate the anxiety brought on by COVID-19.

As we protect ourselves against potential exposure to the coronavirus, keep in mind that social distancing does not mean social isolation and remember that you’re not alone. Look after yourself, get enough sleep, eat well, and reach out to your support network. Engage in activities that benefit your well-being, bring you happiness, and distract you from existing challenges. Set your sights on long-avoided tasks or projects and try something new. The above mentioned tips about self-care are meant to help you thrive in mind, body, and spirit. Coping with stress in positive ways will make you happier, healthier, and stronger.

With the rapid spread of the Coronavirus, also known as COVID-19, we have taken appropriate precautions here at UST to do our part of social distancing by working remotely as we know many of you have as well. Here in our local communities we see fear and panic everywhere—empty shelves at the grocery store, people standing in line for hours to get paper products, schools scrambling to move to a virtual method of teaching, large department stores closing their doors and citizens pushing for cities to lockdown.

New details pour in every day and our inboxes are flooded with shared information from our partners and members across the states. Yesterday, there was an article shared by our partner, ThinkHR, “When Business Threats are Contagious: 10 Answers for Employers Navigating the Coronavirus” that shares questions they have been receiving from HR professionals across the country. They range from how to handle employees refusing to come to work, creating a telecommuting policy and the appropriateness of asking about symptoms. The answers come from their certified HR advisors and is a benefit of our UST HR Workplace product. If you are an HR professional in a business still considering how to navigate these challenging times, you may find some answers here.

Q&A provided by ThinkHR, powering the UST HR Workplace for nonprofit HR teams. Have HR questions? Sign your nonprofit up for a free 30-day trial today.

Question: Is having different parental leave programs for women and men discriminatory?

Answer: Yes. Parental leave must be provided to similarly situated men and women on the same terms. For example, if an employer extends leave to new mothers beyond the period of disability from childbirth (for instance, to provide the mothers time to bond with and/or care for the baby), the employer cannot lawfully fail to provide an equivalent amount of leave to new fathers for the same purpose.

According to Title VII of the Civil Rights Act of 1964, an employer may not discriminate against an employee on the basis of pregnancy, childbirth, or related medical conditions; and women affected by pregnancy, childbirth, or related medical conditions must be treated the same as other persons not so affected but similar in their ability or inability to work. It is important to note that for purposes of determining these Title VII requirements, employers should carefully distinguish between leave related to any physical limitations imposed by pregnancy or childbirth and leave for purposes of bonding with a child and/or providing care for a child (parental leave). Leave related to pregnancy, childbirth, or related medical conditions can be limited to women affected by those conditions.

The Equal Employment Opportunity Commission (EEOC) provides the following examples of nondiscriminatory versus discriminatory leave policies as applied to men and women:

Q&A provided by ThinkHR, powering the UST HR Workplace for nonprofit HR teams. Have HR questions? Sign your nonprofit up for a free 30-day trial here.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.