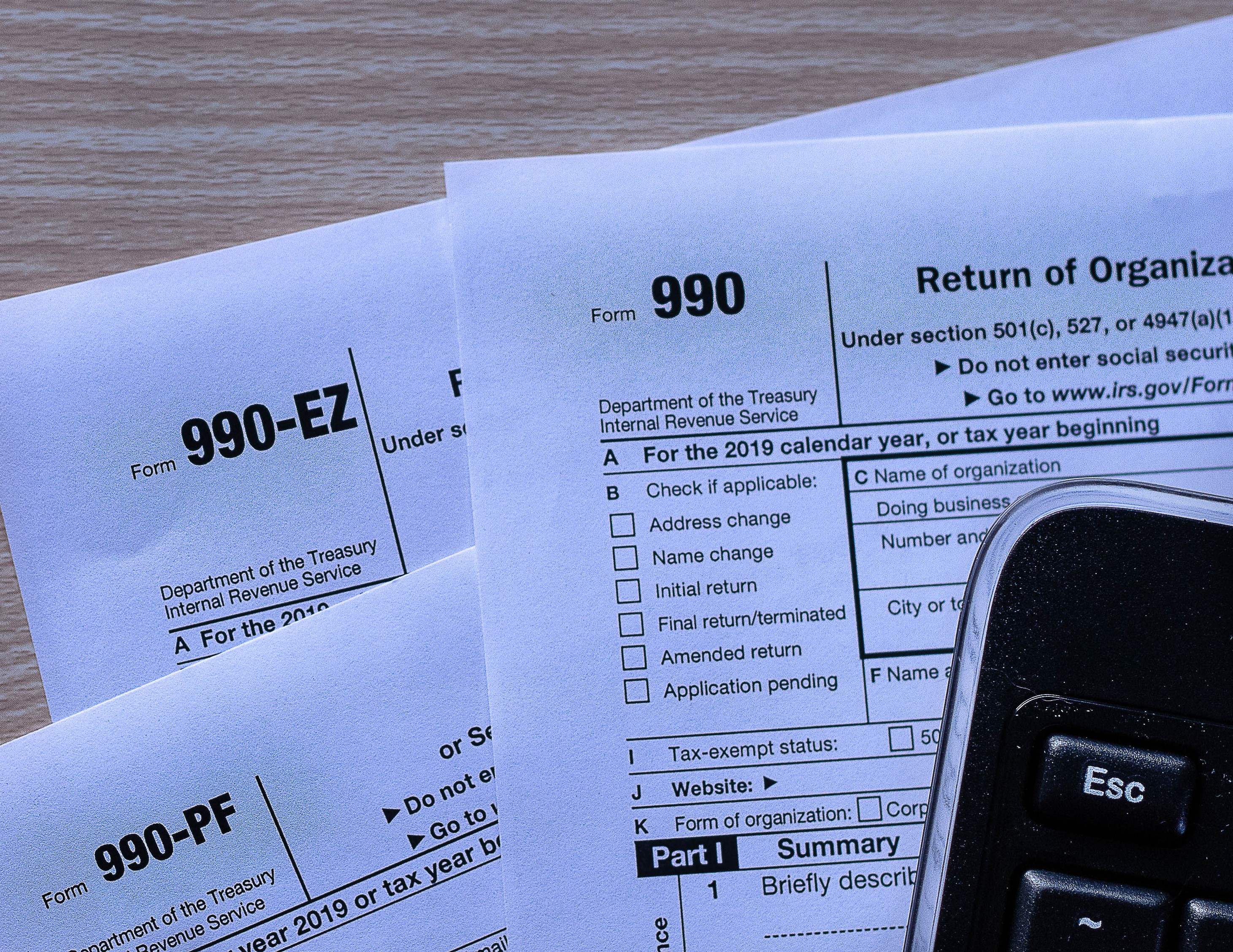

Nobody likes filing taxes or paying them for that matter but don’t let that put your nonprofit at risk. While your organization may be federally tax-exempt, you are still required to file Form 990 with the IRS. This is the only way the federal government can ensure exempt organizations are conducting business in a way that is consistent with their public responsibilities. It also ensures your compliance and evaluates how your nonprofit is doing financially while allowing the public to see information about a nonprofit mission and programs.

The 990 provides a transparent glance into the organization and its accomplishments. Allowing the public to see, not only, the gross revenue generated but where the revenue came from. When individuals, donors or job seekers are trying to find out as much as possible about a nonprofit through their own research efforts, this is an excellent source of information since it serves as a tool to evaluate the best charities to support.

It’s important that you file and file on time. Your 990 is due by the 15th of the 5th month after your accounting period ends. For example, if your fiscal year ends on December 31st, your 990 would be due by May 15th of the following year. Which form you file depends on your gross receipts—you can determine which 990 form to file by visiting the IRS website to see which form category your nonprofit falls under. Take the time to complete this form and avoid losing your exempt status with the IRS—there is no appeal process. If you’re unsure of your status, check the IRS website and get back on track, you will thank yourself later.

Understanding the journey, planning ahead and being proactive, will save you time and make the filing process much easier. Following the below guidelines can help with that preparation:

Since 990 forms are public documents and widely available, nonprofits should be diligent about filing them out correctly and filing them on time. Remember, a nonprofit’s 990 provides valuable information that speaks directly to your organizations status so the extra time spent preparing will pay off in the end. Don’t think of it as another menial task on your list of things to do but rather consider how it can affect those researching who you are—ultimately impacting the communities you serve.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.